May Consumer Confidence Holds Steady

(Chart courtesy Wells Fargo Securities.)

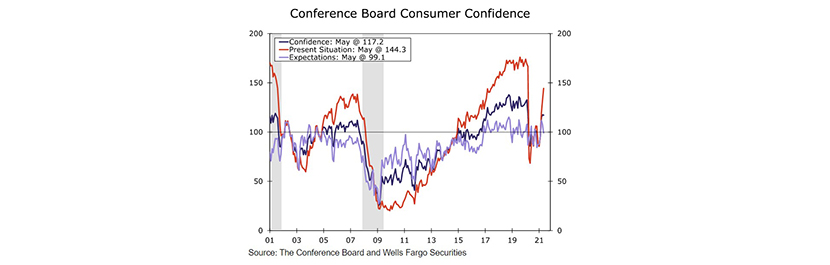

The Conference Board, New York, reported its monthly Consumer Confidence Index held steady in May, following a gain in April. The Index now stands at 117.2, down marginally from 117.5 in April.

The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—increased from 131.9 to 144.3. However, the Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—fell to 99.1 in May, down from 107.9 last month.

“Consumers’ assessment of present-day conditions improved, suggesting economic growth remains robust in Q2,” said Lynn Franco, Senior Director of Economic Indicators with The Conference Board. “However, consumers’ short-term optimism retreated, prompted by expectations of decelerating growth and softening labor market conditions in the months ahead. Consumers were also less upbeat this month about their income prospects—a reflection, perhaps, of both rising inflation expectations and a waning of further government support until expanded Child Tax Credit payments begin reaching parents in July. Overall, consumers remain optimistic, and confidence should remain resilient in the short term, as vaccination rates climb, COVID-19 cases decline further, and the economy fully reopens.”

“Consumers’ assessment of the present situation rose to a post-pandemic high, but confidence is waning slightly and expectations about the future are less rosy,” said Tim Quinlan, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “It is great to be able to take the masks off, but a pandemic mindset is not an easy thing to shake; consumers might need a minute.”

Quinlan said the longer-term outlook remains uncertain. “A case can be made that while consumer see a light at the end of the tunnel, some are still wondering if that light is an oncoming train,” he said. “A pandemic mindset, we are learning, is a hard thing to shake. Consider the temporary shutdown of the Colonial Pipeline during the month. With memories of empty shelves in the paper goods aisle at the grocery store, many consumers raced to the nearest gas station to top up their tanks contributing to the supply problem and temporarily leaving many stations on the East Coast with bags over the pump handles as fuel ran dry.”

The report said consumers’ appraisal of current conditions improved in May. The percentage of consumers claiming business conditions are “good” fell from 19.4 percent to 18.7 percent, but the proportion claiming business conditions are “bad” also declined, from 24.5 percent to 21.8 percent. Consumers’ assessment of the labor market improved. The percentage of consumers saying jobs are “plentiful” climbed from 36.3 percent to 46.8 percent, while those claiming jobs are “hard to get” declined from 14.7 percent to 12.2 percent.

Consumers’ optimism about the short-term outlook waned in May. The percentage of consumers expecting business conditions to improve over the next six months fell from 33.1 percent to 30.3 percent, while the proportion expecting business conditions to worsen rose from 12.1 percent to 14.8 percent. Consumers were also less upbeat about the job market. The proportion expecting more jobs in the months ahead fell from 31.7 percent to 27.2 percent, while those anticipating fewer jobs rose from 14.4 percent last month to 17.3 percent in May.

Regarding short-term income prospects, 14.5 percent of consumers expect their incomes to increase in the next six months, down from 17.4 percent in April. The proportion expecting their incomes to decrease also fell, from 10.5 percent in April to 9.3 percent in May.