Home Prices Maintain Robust Pace

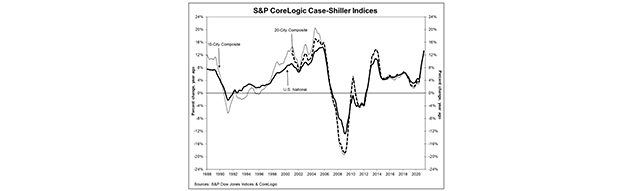

(Chart courtesy S&P CoreLogic Case-Shiller.)

Home prices continued to post double-digit annual gains amid a red-hot spring housing market, according to the Standard & Poor’s CoreLogic Case-Shiller Indices.

The report said the U.S. National Home Price NSA Index posted a 13.2% annual gain in March, up from 12% in February—the 10th consecutive monthly increase. The 10-City Composite annual increase came in at 12.8%, up from 11.7%. The 20-City Composite posted a 13.3% year-over-year gain, up from 12% in March.

Phoenix led the 20-City Composite with a 20% year-over-year price increase, followed by San Diego at 19.1% and Seattle at 18.3%. All 20 cities reported higher price increases in the year ending March.

Month-over-month, before seasonal adjustment, the U.S. National Index posted a 2% increase in March, while the 10-City and 20-City Composites posted increases of 2.0% and 2.2%, respectively. After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.5%, while the 10-City and 20-City Composites posted increases of 1.4% and 1.6%, respectively. All 20 cities reported increases before and after seasonal adjustments.

“Housing prices continued to rise robustly in March,” said Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy with S&P DJI. “The National Composite’s 13.2% gain was last exceeded more than 15 years ago in December 2005, and lies very comfortably in the top decile of historical performance.”

Lazzara said data are consistent with the hypothesis that COVID has encouraged potential buyers to move from urban apartments to suburban homes. “This demand may represent buyers who accelerated purchases that would have happened anyway over the next several years,” he said. “Alternatively, there may have been a secular change in preferences, leading to a permanent shift in the demand curve for housing. More time and data will be required to analyze this question.”

The report said as of March, average home prices for the MSAs within the 10-City and 20-City Composites are exceeding their winter 2007 levels.

“Massive home buying demand shows no signs of abating despite some rise in mortgage rates and concerns of overheated home price growth,” said CoreLogic Deputy Chief Economist Selma Hepp. “At the same time, hopes that new listings would proliferate as mass vaccinations encourage baby boomers to list their homes is showing little signs of taking place. Thus, pressures on home prices continued to mount.”

“The surge in home prices reflects a huge supply-demand imbalance that may take at least a couple of years to reconcile,” said Mark Vitner, Senior Economist with Wells Fargo Securities, Charlotte, N.C. “The supply of housing has been constrained since the housing bust 13 years ago. The home building industry has consolidated since then and the supply of lots has grown very slowly, as residential development turned back toward major urban centers. The pandemic set off a major shift in housing preferences, with more people looking to own versus rent.

Vitner said the shift toward homeownership, particularly among Millennials, has set of an affordability migration to the suburbs or less costly housing markets in the Southeast and Mountain West. “Moreover, the lockdowns and repeated stimulus programs over the past year have bolstered savings, providing more households with the means to purchase a home,” he said.