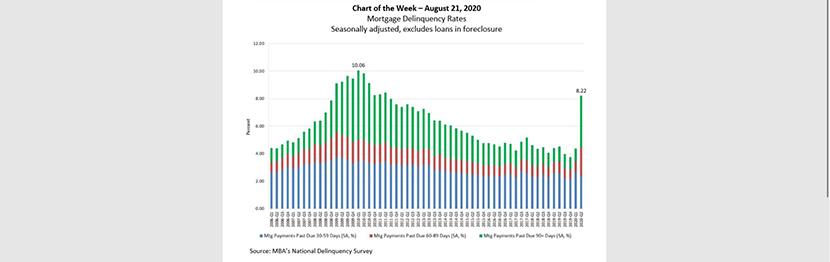

MBA Chart of the Week: Mortgage Delinquency Rates

MBA released its National Delinquency Survey results for the second quarter last week. Key findings revealed that the COVID-19 pandemic’s effects on some homeowners’ ability to make their mortgage payments could not be more apparent.

Mortgage delinquencies spiked 386 basis points from the first quarter to the second quarter to a seasonally adjusted rate of 8.22 percent –the highest overall delinquency rate in nine years. At its peak in the first quarter of 2010, the delinquency rate reached 10.06 percent.

There was also a movement of loans to later stages of delinquency in the second quarter. The 60-day delinquency rate reached a new survey high of 2.15 percent, and the 90+-day delinquency rate climbed to its highest level since the third quarter of 2010 at 3.72 percent.

On a more positive note, 30-day delinquencies dropped in the second quarter by 33 basis points to 2.34 percent, which could be an indication that the flood of new delinquencies may be dissipating.

Note: For the purposes of this survey, MBA asks servicers to report the loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.

– Anh Doan (adoan@mba.org); Marina Walsh (mwalsh@mba.org)