ACES Quality Management: Overall Critical Defect Rate Increases

(Illustration credit: Artem Podrez via Pexels.com)

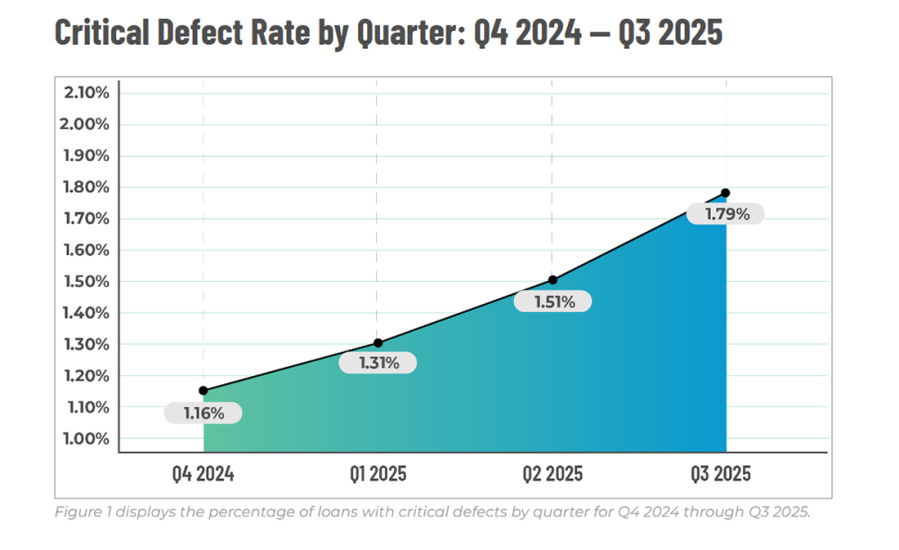

ACES Quality Management, Denver, reported the overall critical defect rate increased from 1.51% in Q2 2025 to 1.79% in Q3 2025, an 18.5% increase.

“While the overall critical defect rate increased again in the third quarter, the underlying data points to a market adjusting to a shifting mix rather than a broad decline in manufacturing quality,” said Nick Volpe, executive vice president of ACES Quality Management.

Volpe noted the increase was driven primarily by concentrated deterioration in income- and compliance-related findings, “reinforcing the importance of documentation integrity and disciplined validation as refinance activity expands and lenders continue to operate lean.”

The firm’s quarterly ACES Mortgage QC Industry Trends Report covering the third quarter found that Income/Employment defects remain the largest defect category, increasing 47.6% from 18.45% to 27.24% of all critical defects.

Legal/Regulatory/Compliance defects increased from 16.24% to 18.97%, a 16.8% jump. But Borrower/Mortgage Eligibility defects decreased 56.5%, declining from 15.87% to 6.90%.

The Purchase Defect share decreased to 62.65%, while the Refinance Defect share increased to 37.35% as refinance review share expanded, ACES reported.

The report said conventional loans accounted for 57.18% of all critical defects, FHA for 31.10% and VA for 11.00%, “reflecting relative stability across products with modest shifts in defect concentration.”

ACES examines post-closing quality control data derived from the ACES Quality Management and Control benchmarking system for its QC Industry Trends Report. The report also incorporates data from prior quarters where applicable. All reviews and defect data evaluated for the report were based on loan audits selected by lenders for full file reviews.