New American Funding, Tustin, Calif., launched a mentorship program to help team members develop professionally. New American Funding’s “360 Mentorship Program” matches an internal leader with another employee who is pursuing career advancement.

Category: News and Trends

The Week Ahead—Dec. 21, 2020

With Christmas—and the Christmas holiday break—just days away, the situation in Washington is, as usual, as chaotic as it could be. As of this writing, House and Senate negotiators are STILL working on a substantial $900 billion-plus coronavirus relief bill, which is keeping the 116th Congress from formally adjourning. And there’s still the defense appropriations bill, which triggered yet another government shutdown on Friday.

MBA Advocacy Update–Dec. 21, 2020

MBA – along with several trades – sent a letter to Treasury Secretary Steven Mnuchin expressing concerns regarding the possible release of the GSEs from conservatorship. On Wednesday, FHFA released a final rule extending the current single-family and multifamily GSE affordable housing goals by one year, through 2021.

Chetan Patel of Verity Global Solutions on Managing Costs in a Transitioning Market

Chetan Patel is COO of Verity Global Solutions, San Antonio, Texas, a provider of highly crafted services spanning the mortgage loan lifecycle. He has more than 25 years of leadership experience in the mortgage industry and has been recognized as an IT All-Star by Mortgage Banking magazine.

The Redesigned URLA Mandate Is Around the Corner. Will Your Technology Solution Be Ready?

December is always a busy month, and this is especially true for mortgage lenders this year. With 2021 rapidly approaching, the deadline to implement the redesigned URLA and updated automated underwriting system (AUS) datasets will be here before we know it.

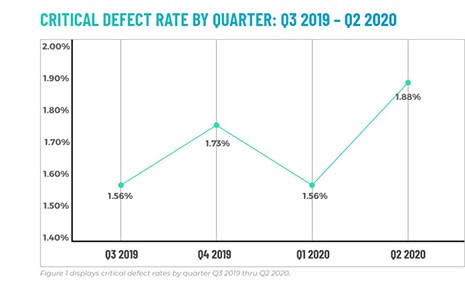

ACES: Critical Defect Rate Highest Since 2018

ACES Quality Management, Denver, said its quarterly Mortgage QC Trends Report for the second quarter reported the overall critical defect rate of 1.88% is the highest quarterly rate since 2018.

FHFA Issues Proposed Rulemaking for Enterprise Liquidity Requirements, Seeks Comments

The Federal Housing Finance Agency, Washington, D.C., announced it would like comments on a proposed rulemaking regarding Fannie Mae and Freddie Mac liquidity requirements.

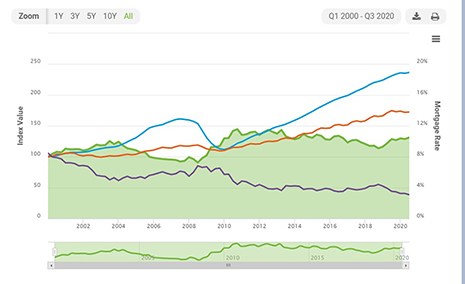

Apartment Investment Bounces Back in Third Quarter

Freddie Mac, McLean, Va., said its Apartment Investment Market Index turned positive in the third quarter despite contractions in several major metros.

Dealmaker: CBRE Brokers $22M in Industrial, Office Sales

CBRE brokered industrial and office property transactions totaling $22.1 million in the San Diego area.

People in the News Dec. 18, 2020

Promontory MortgagePath LLC, Danbury, Conn., hired Elisha Werner as chief compliance officer for mortgage operations. She will lead compliance efforts for the company’s residential mortgage operations and oversee the regulatory and compliance implementation process including contributing to and testing the company’s compliance controls and digital mortgage origination technology.