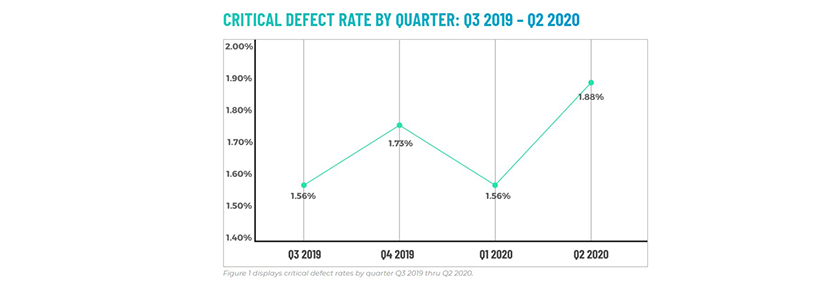

ACES: Critical Defect Rate Highest Since 2018

ACES Quality Management, Denver, said its quarterly Mortgage QC Trends Report for the second quarter reported the overall critical defect rate of 1.88% is the highest quarterly rate since 2018.

The report said the defect increase was driven primarily by a 64% increase in the Income/Employment category. While defects were down in the overall majority of categories, three of the four key borrower qualification categories saw significant defect rate increases compared the first quarter.

The report also noted early payment defaults increased 197% through September compared to last year. “We are still seeing a tremendous increase overall in EPDs as compared to 2019, making it too early to predict when EPDs will peak. Any continued rise is likely to exacerbate long-term default and loss rates, signaling that lenders must remain vigilant of the risks this might pose to their organizations,” said ACES CEO Trevor Gauthier.

“While evidence of COVID-19’s impact on loan quality was present in the Q1 data, Q2 is where ‘The COVID Effect’ becomes truly apparent, resulting in the highest critical defect rate observed since Q4 2018,” said ACES Executive Vice President Nick Volpe. “One of the biggest drivers of this increase was the rise in Income/Employment-related defects – a wholly unsurprising outcome given the challenges nearly all employers faced in transitioning to a remote working environment.”

Findings for the report are based on post-closing quality control data from over 90,000 unique loans and are categorized using the Fannie Mae loan defect taxonomy. All reviews and defect data evaluated for the report were based on loan audits selected by lenders for full file reviews.

“In many respects, the mortgage industry and the world at large remain in a ‘wait-and-see’ mode,” Volpe said. “As such, we expect higher than normal volatility in the critical defect rate for the remaining quarters of 2020 and into 2021, though loan volumes should remain high next year thanks to the ongoing low-interest-rate environment.”