Apartment Investment Bounces Back in Third Quarter

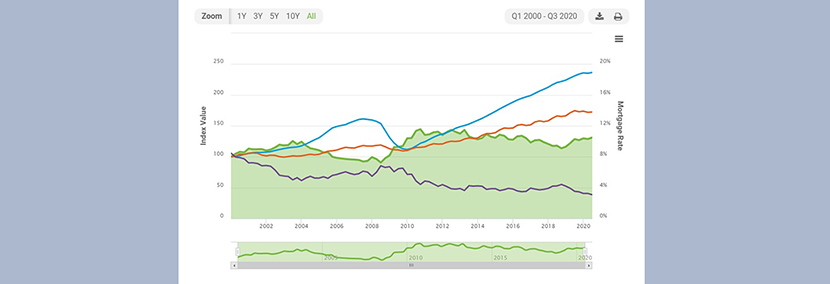

Chart courtesy of Freddie Mac Multifamily

Freddie Mac, McLean, Va., said its Apartment Investment Market Index turned positive in the third quarter despite contractions in several major metros.

The Freddie Mac Multifamily Apartment Investment Market Index rose 1.9 percent during the quarter after declining 0.3 percent in the second quarter.

The change reflected a quarter with mixed net operating income and property price growth after the COVID-19 pandemic drove negative NOI growth in the second quarter. On an annual basis, AIMI rose by 2.0 percent as mortgage rates decreased by 44 basis points.

“AIMI rebounded in the third quarter as mortgage rates dropped and despite the stresses created by COVID-19, multifamily fundaments have been relatively resilient to date,” said Freddie Mac Multifamily Vice President of Research and Modeling Steve Guggenmos.

Guggenmos noted that though AIMI remains positive on an annual basis nationally, “some individual markets are experiencing significant contractions due to the local market impact of the pandemic,” he said.

Over the quarter, AIMI increased in the nation and in most markets. Guggenmos said 19 markets Freddie Mac studied experienced quarterly growth while six metros experienced quarterly contraction.

NOI growth was very mixed, Freddie Mac said. The nation and 12 markets studied experienced quarterly NOI growth while NOI contracted in 10 markets. NOI in three metros was virtually unchanged. New York and San Francisco experienced NOI contraction of -8.0 percent and -8.9 percent, respectively.

Property price growth was also mixed. Prices grew in the nation and in 12 markets while prices dropped in 11 markets. Three markets experienced almost no property price change.

Mortgage rates decreased by 16 basis points during the quarter.

Over the past year, AIMI increased in the nation and in 17 markets, while eight markets experienced an AIMI drop.

NOI dropped in the nation and in 18 markets; New York and San Francisco posted double-digit NOI losses. The report said seven markets posted annual NOI gains, including Jacksonville, Fla., and Phoenix, which both exceeded 3 percent growth.

The nation and 18 markets experienced property price growth, while seven metros experienced contraction on an annual basis.

Mortgage rates decreased by 44 basis points during the last year. The report called this a large drop, “but not as severe as the annual rate dropped in each of the last four quarters.”