BREAKING NEWS

Applications Fall to 22-Year Low in MBA Weekly Survey

Mortgage applications fell to their lowest level in 22 years, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending August 12.

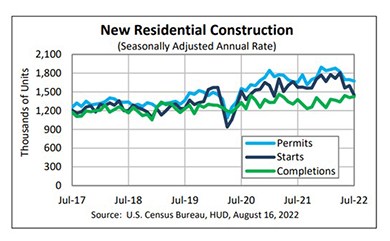

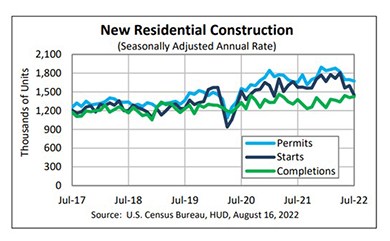

It already hasn’t been a good week for housing. On Monday, the National Association of Home Builders reported its Housing Market Index fell for the eighth straight month to two-year low. And on Tuesday, HUD and the Census Bureau reported housing starts fell in July by nearly double digits to its slowest pace since 2020.

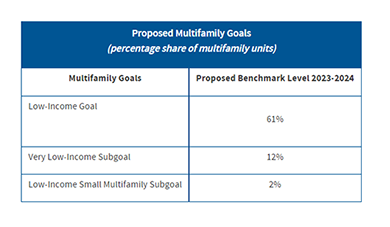

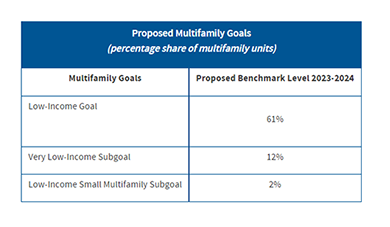

The Federal Housing Finance Agency on Tuesday proposed new benchmark levels for Fannie Mae and Freddie Mac multifamily housing goals in 2023 and 2024.

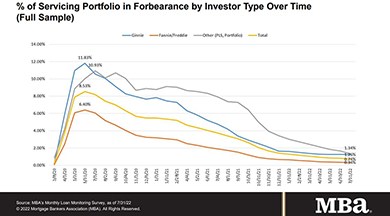

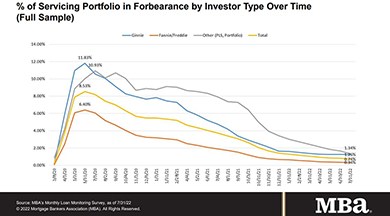

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 7 basis points to 0.74% of servicers’ portfolio volume as of July 31, from 0.81% in June. MBA estimates 370,000 homeowners remain in forbearance plans.

MBA CONVERGENCE presents the next in its webinar series, What Does it Cost to Produce a Unit of Housing? Costs & Elements of Production, on Thursday, Aug. 25 from 2:00-3:00 p.m. ET.

Ascent Software Group LLC provides the Jaro suite of appraisal tools. Ascent brings changes to the valuation process through automation and deep integration to the entire end to end workflow. At Jaro, we build more than tech—We forge connections.

Mesirow Financial Holdings, Chicago, led the $275 million refinancing of NASA's headquarters at 300 E Street SW in Washington, D.C.

Regardless of the reasons, the one thing that is clear is homeowners who took advantage of the historical low-rate mortgage environment should be prime targets for new home equity acquisitions.

Chris Sabbe is Senior Vice President of Enterprise Sales for PHH Mortgage. A recognized leader in the subservicing industry, he is responsible for managing and growing the company’s enterprise sales and actively onboarding new MSR/Co-Issue sellers.

teve Ferringer is Executive Vice President of Enterprise Business Development with INCENTER LLC, Fort Washington, Pa. Incenter helps mortgage bankers optimize processes and improve performance.

Cybercriminals have ramped up their attacks on the mortgage and real estate industries, taking advantage of the multiple entry points available in every transaction, the lack of coordinated security efforts among the parties, and the abundance of personal and financial information that awaits them after a successful breach.

When borrowers make or miss a payment, their calls usually come through to a loan servicer rather than the lender itself. The servicer must therefore act as an extension of the lender’s business with two main objectives: deliver effective customer care and mitigate loss.

Using insights, inspirations and proven principles he has applied to his legendary teams and coaching career, Mike Krzyzewski (Coach K) sits down with 2023 MBA Chairman Matt Rocco to discuss clear, passionate guidelines on reaching for and achieving success at the MBA Annual Convention & Expo on Tuesday, Oct. 25.