Ken Flaherty of Curinos: Five Ways to Benefit from a Home Equity Comeback

Ken Flaherty is Senior Consumer Lending Market Analyst with Curinos, Columbus, Ohio. This article first appeared in the Curinos blog page: Five Ways to Benefit from a Home Equity Comeback – Curinos.

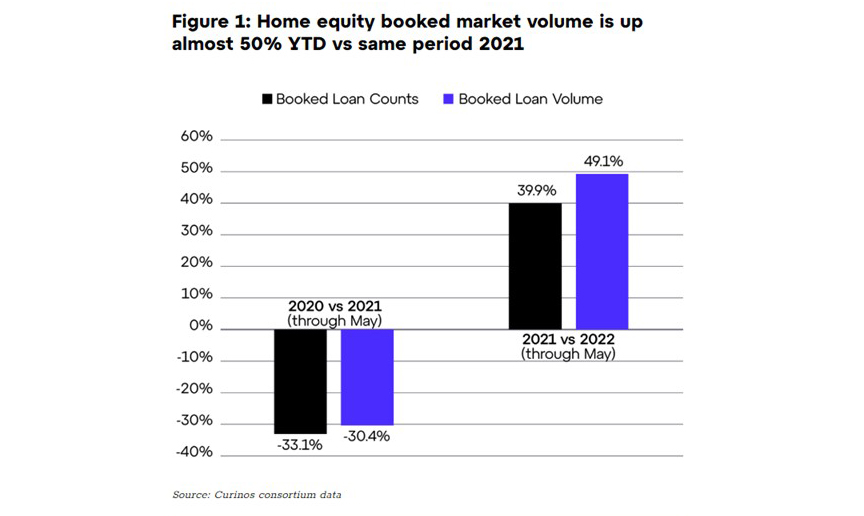

We are halfway through 2022 and home lending has swiftly shifted in a direction that many didn’t predict. U.S. mortgage rates have soared above 5%, ARM volume accounts for more than 20% of all mortgage refinance and purchases transactions. Home equity volume is up more than 40% from 2021. (See Figure 1.)

In fact, the ratio of mortgage cash-out applications versus home equity applications did a complete turnaround in the second quarter. Home equity transactions now make up more than 50% of all cash-out transactions in the U.S., up from less than a third in 2020-2021.

How can lenders capitalize on this shift in demand? Curinos believes lenders can target customers based on their circumstances and likely behaviors.

- Target Recent Mortgage Vintages

Mortgage rates are rising, home prices are at historical highs and homeowners are eager to start their backyard project or make that large purchase they’ve been putting off for a few years.

Regardless of the reasons, the one thing that is clear is homeowners who took advantage of the historical low-rate mortgage environment should be prime targets for new home equity acquisitions. With average mortgage rates at around 3% for most of 2020-2021, (and at times even in the upper 2% range), a new junior home equity lien allows these homeowners to preserve their low first-mortgage rate while also allowing them to access the equity in their home for their cash-out needs. While this isn’t a new strategy for lenders, what makes it different and easier now is the sheer volume of new and existing mortgage customers who are equity rich with a very low fixed-rate first mortgage.

2. Prioritize your Existing HELOC Portfolio

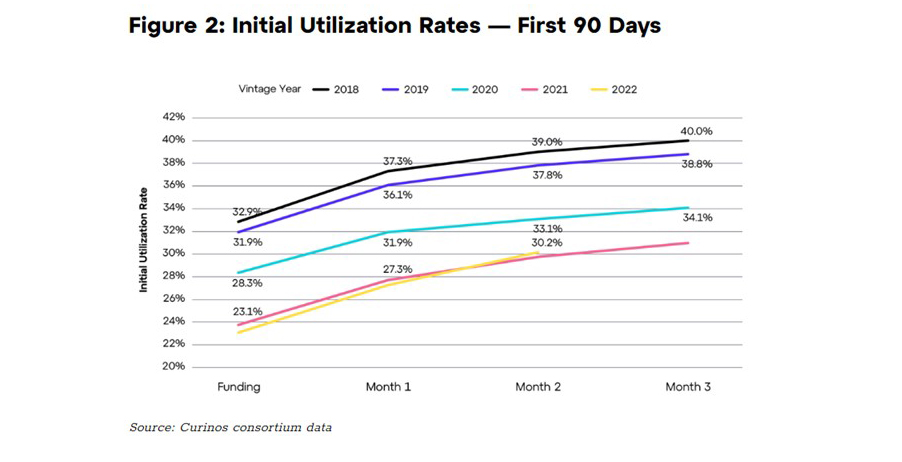

While it’s important for lenders to capitalize on the current lending environment and capture as many new home equity originations as possible, lenders shouldn’t forget about the existing HELOC customers who are already on their books. The average utilization (drawn balance-to-line commitment) on a new HELOC originated prior to 2020 was approximately 37% after 90 days on the books. But the average utilization on a new HELOC originated after 2020 has averaged less than 30% after 90 days on the books. This signals both a shift in borrower usage of HELOCs and very real opportunity for lenders with these portfolios to incentivize utilization on these recent vintages. (See Figure 2.) Finding ways to incentivize underutilized HELOC customers will be key for lenders, not only to drive lifetime profitability, but to help offset lost mortgage revenue. This can be accomplished through the unique feature of HELOCs that drives new, incremental interest income dollars throughout the entirety of the customer’s draw period. Home equity understandably took a back seat to mortgage originations the last few years, making this a perfect time to reeducate the workforce on HELOC features, benefits and usage functions to those HELOC customers. With many households experiencing cash flow strain due to rising inflation, high gas prices, declining savings accounts and the potential of reduced spending, it may be wise to remind customers that HELOCs can be used as a source of cash for virtually everything from home improvements to debt consolidation, tuition expenses and more.

3. Adopt Risk-Based Pricing and Consider Other Metrics

When it comes to strategies for new home equity origination, pricing is a component that has generally been overlooked by many lenders. As new and old home equity lenders enter a very crowded market, pricing differentiation and discipline will be key for lenders who are looking to drive both volume and interest income. It’s important for lenders to align their pricing strategy under three basic concepts: risk appetite, market conditions and historical borrower behavior. A risk-based pricing strategy allows lenders to pay themselves for the risks associated with each segment of the lending landscape that covers their risk exposure, market competitiveness and, most importantly, how a customer will perform. That means taking into account the customer’s likelihood of utilization, pre-payment speeds, delinquency and other behavior. Far too often we see lenders fall victim to an underperfoming HELOC portfolio, both in utilized dollars and net interest margin (NIM). Segment-based pricing that recognizes and rewards different customer behaviors and risks will be essential for optimizing the book going forward.

4. Overhaul Sales Strategy

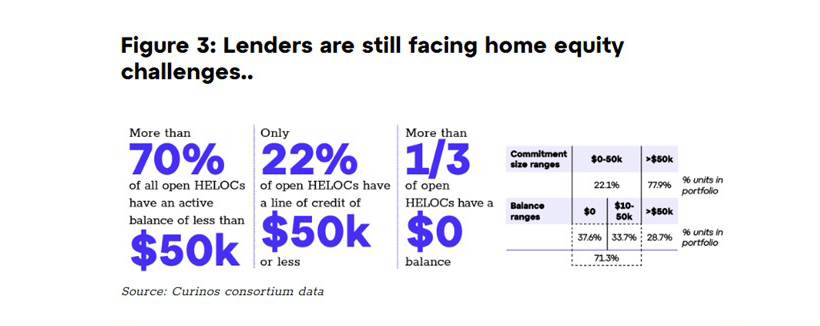

While demand may be strong for home equity now, the age-old sales strategy by most lenders to drive the highest possible line amount that the borrower qualifies for isn’t necessarily the ideal sales approach. Although these practices are common, they generally create a mismatch in borrower’s actual immediate needs, strain the lenders by almost forcing low utilization and higher capital expense costs for the unused portion of one’s credit lines. (See Figure 3.) More than 70% of HELOCs sitting on lenders’ books have an active balance of $50,000 or less, but only 22% of HELOCs have a line up to $50,000. This means that close to 80% of HELOCs sitting on lenders’ portfolios have a line size that exceeds the borrower’s actual drawn balance. In an environment where driving NIM is so much more important to lenders who want to offset lost revenue from the drop in mortgage originations, it’s apparent there is an opportunity for lenders to shift the sales strategy. Lenders can incentivize day-one HELOC utilization, longer-term utilization and eliminate excessive line sizes that end up costing capital expense charge. Re-training sales teams can admittedly be challenging. Management can start with the basic sales concept of drawn balance incentives versus line amount incentives. This can be quickly understood and implemented to make a material difference in a lender’s portfolio composition.

5. Improve Customer Experience

As more non-banks enter the home equity market promising cycle times of less than 10 days and a fully-digitized application process, traditional banks and credit unions are scrambling to do the same. It has been encouraging to see a high number of existing home equity lenders recently turn their attention on their operational components, putting the magnifying glass on the application process, origination system and fulfillment processes. These are all necessary steps to align origination processes with customer demand, putting the customers in direct control. This includes not only inputting their application through a digital portal, but also allowing them to navigate each step of the fulfillment process and know exactly where their loan stands each step of the way. Additionally, lenders should look at ways they can allow customers to access the funds on their HELOC digitally such as online transfer functionality and credit card access rather than relying on paper checks or in-person branch visit to draw funds from their HELOC. In an environment where balances are essential to maximizing interest income, creating a HELOC customer journey that is digitally driven and easily accessible could change the landscape for lenders and keep home equity in the forefront for years to come.

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)