Zillow: Lowest-Priced Homes Attract Strongest Competition

As home-buying demand cools from last year’s record pace, competition is now hottest for the lowest-priced homes as affordability obstacles stretch buyers’ budgets, said Zillow, Seattle.

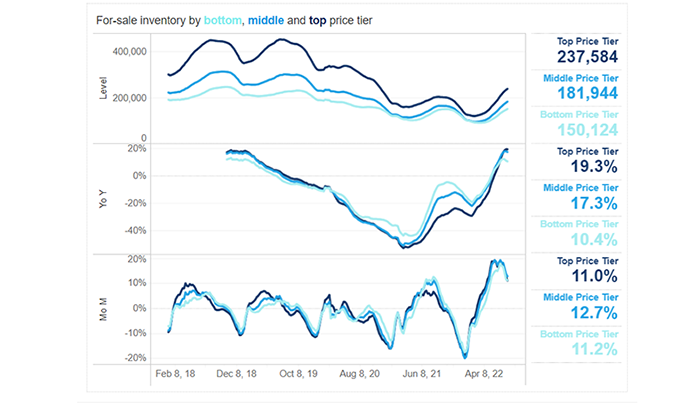

Throughout most of the pandemic, buyers shopping in the middle and top price tiers faced the strongest competition–inventory was relatively lower and there were more sales. But now, inventory for the least expensive homes is tightest and the sales gap has closed.

“Buyers are stretched thin when it comes to affordability, and they are flocking to the lowest-priced homes on the market to get their foot in the door,” said Nicole Bachaud, Senior Economist with Zillow. “Still, the less frenzied market compared to last year will feel like a breath of fresh air for those buyers who haven’t been priced out.”

Bachaud noted the market has not yet shifted to a buyers’ market, “but it’s becoming a better time to buy, with more time to consider options and less chance of being dragged into a bidding war,” she said. “Demand is lighter for homes at the top end of the market and owners appear to be reluctant to sell and move to a different home that will presumably come with a much higher monthly payment at today’s mortgage rates.”

Inventory shifts, sales and price cuts show the market is “rebalancing” after perhaps the most competitive period ever, Zillow said. “Home sellers are adjusting their expectations to the current reality, and buyers have more negotiating leverage than they have had since the onset of the pandemic. Still, home prices are at or near record highs, pushing buyers who remain in the market toward homes in the lower end of the price range,” the report said.

Inventory in the most expensive third of the housing market was up 19.3% from a year ago, Zillow reported. Similarly, inventory in the middle third was up 17.3% annually. Inventory is growing in the lowest-priced third as well, but only by 10.4% from a year ago. During the same period in 2021, inventory in the least expensive tier grew on a monthly basis at nearly twice the rate of the most expensive homes.

Home sales fell more than 24% year-over-year. But home sales in the lowest price tier were down just 14.2% annually compared to 20.3% and 25.4% annual declines in the mid- and high-priced tiers, respectively.

Along with inventory and sales volume, the share of listings with a price cut also indicates heavier demand for lower-priced homes. “For much of the pandemic, the share of listings with a price cut tracked similarly across price tiers. During the past few months, as mortgage rates climbed from pandemic lows, a larger share of mid- and high-priced listings have been receiving a price cut as sellers are having a harder time attracting buyers,” Zillow said.