FHFA Proposes 2023-2024 Fannie Mae, Freddie Mac Multifamily Housing Goals

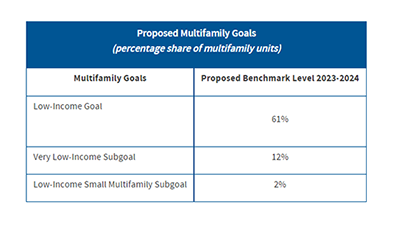

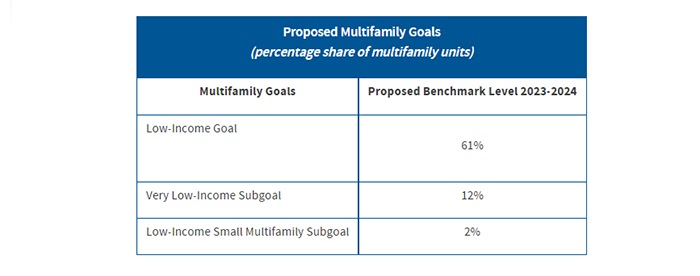

The Federal Housing Finance Agency on Tuesday proposed new benchmark levels for Fannie Mae and Freddie Mac multifamily housing goals in 2023 and 2024.

The proposed rule offers a new methodology for measuring the enterprises’ multifamily housing goals. Rather than measuring the goals based on the number of units financed, the proposed rule would use the percentage of each enterprise’s annual multifamily loan acquisitions that are affordable to each income category.

FHFA Director Sandra L. Thompson said the proposed rule would ensure each enterprise focuses on affordable segments of the multifamily market and noted it reaffirms FHFA’s commitment to promoting affordability nationwide. “The proposed change to the methodology will make the multifamily housing goals more responsive to market conditions,” she said.

FHFA previously established benchmark levels in December 2021 for enterprise multifamily housing goals for 2022 only. At the time FHFA noted it established multifamily levels for a single year due to market uncertainty resulting from the COVID-19 pandemic and the potential for unforeseen changes to multifamily market conditions beyond 2022.

FHFA establishes annual housing goals for the Enterprises and assesses their performance under the housing goals each year. FHFA did not propose any changes to the underlying criteria that determine which multifamily units qualify for credit under the housing goals in this proposed rule.

Interested parties are invited to submit comments on this proposed rule within 60 days of publication in the Federal Register. Comments should be submitted via FHFA’s website or mailed to the Federal Housing Finance Agency, Division of Housing Mission and Goals, 400 7th Street, S.W., Washington, DC 20219.