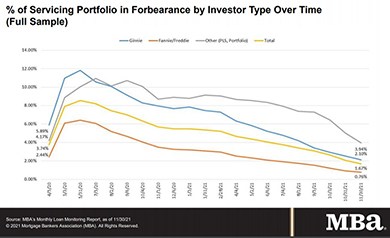

MBA Loan Monitoring Survey: Mortgage Loans in Forbearance Fall to 1.67%

The Mortgage Bankers Association’s new monthly Loan Monitoring Survey reported loans now in forbearance decreased by 39 basis points to 1.67% of servicers’ portfolio volume as of November 30 from 2.06% in October. MBA estimates 835,000 homeowners remain in forbearance plans.

CFPB, DOJ Issue Joint Letters on Servicemember/Veterans’ Rights

The Consumer Financial Protection Bureau and the Department of Justice on Monday issued two joint letters Monday on legal housing protections for military families.

MBA: 3Q Holdings of Commercial/Multifamily Mortgage Debt Increase

Commercial/multifamily mortgage debt outstanding increased by $64.8 billion (1.6 percent) in the third quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding report.

Federal Agencies Make No Changes to QRM Definition

Six federal agencies issued notice on Tuesday that they will not modify their current definition of a Qualified Residential Mortgage.

FHFA Proposes Capital Planning Rule for Fannie Mae, Freddie Mac

The Federal Housing Finance Agency issued a proposed rule on Thursday that would require Fannie Mae and Freddie Mac to develop, maintain and submit annual capital plans.

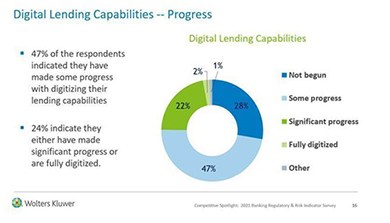

Survey Details Lenders’ ‘Substantial’ Risk, Compliance Concerns

Regulatory compliance and risk concerns remain elevated in a number of key areas for U.S. banks and credit unions, according to results of Wolters Kluwer’s 2021 Regulatory & Risk Management Indicator survey.

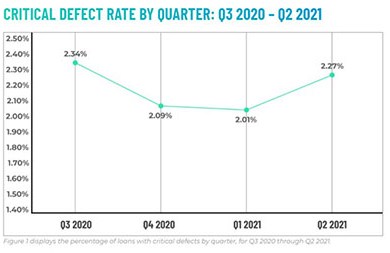

ACES: Q2 Critical Defect Rate Up 13%

ACES Quality Management, Denver, reported a13% increase in overall critical defect rates to 2.27%, ending a multi-quarter trend of improvement.