Survey Details Lenders’ ‘Substantial’ Risk, Compliance Concerns

Regulatory compliance and risk concerns remain elevated in a number of key areas for U.S. banks and credit unions, according to results of Wolters Kluwer’s 2021 Regulatory & Risk Management Indicator survey.

This year’s survey, conducted by Wolters Kluwer Compliance Solutions, generated a Main Indicator Score of 128, a 25-point increase over the 2020 score. This jump was prompted by continuing concerns about navigating regulatory changes, managing risk across all lines of business and an increase in the dollar amount of fines imposed by regulators. The 2021 survey results mark the third consecutive year of an increase in the Main Score.

Threat of ransomware attacks led the list of factors in organizations’ enterprise risk planning, with 63 percent giving it “significant consideration” and another 22 percent marking it for “some consideration” in their planning. The pandemic’s ongoing impacts continued to weigh heavily on respondents’ minds, with 49 percent citing it as a significant concern in enterprise risk planning, followed by loan default risk (46 percent) and inflation concerns (42 percent). Other areas of high concern include business resilience and adaptability (41 percent), recession fears (34 percent), and climate-related financial risks (21 percent).

“Relatively high levels of concern remain across a range of areas, reinforcing the fact that regulatory compliance and risk management issues continue to pose challenges for financial institutions,” said Timothy R. Burniston, Senior Advisor for Regulatory Strategy with Wolters Kluwer Compliance Solutions. “Respondents expressed their highest levels of confidence in the past four years regarding their organizations’ ability to track regulatory changes and document compliance with those requirements to regulators. Nonetheless, the level of concern is still high.”

The Indicator was conducted nationwide between August 4 and September 6 and generated 391 responses. Over the past three years, the annual Indicator score has increased by 43 points in total, moving from a score of 85 in 2018 to 95 in 2019; to 103 in 2020; to 128 this year.

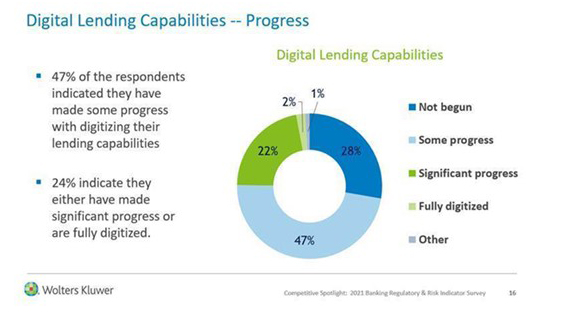

A question about investing in banks’ digital transformation efforts was a new element in this year’s Indicator, with 63 percent anticipating a “significant” or “some” acceleration of their organization’s digital lending processes. Forty-seven percent of the respondents indicated they have made some progress with digitizing their lending capabilities, with 24 percent indicating they either have made significant progress or are fully digitized.

Among the top obstacles cited in implementing effective compliance programs, 45 percent ranked manual compliance processes as a “7” or higher concern on a 10-point scale, and 41 percent cited inadequate staffing, virtually the same as 2020 levels. Forty-one percent of respondents felt that regulatory scrutiny of fair lending programs remained unchanged, down just one percent from last year’s survey.

Looking to 2022, top risk management priorities identified include cybersecurity (70 percent), compliance risk and credit risk (both at 43 percent), with concerns about credit risk having decreased 18 percentage points from 2020’s survey results. Forty-seven percent of respondents anticipate an acceleration of investments in their regulatory change management processes.

When asked about the prospects for reduced regulatory burden the next two years, respondents revealed greater pessimism, with 72 percent citing the likelihood of regulatory relief as either “somewhat unlikely” or “very unlikely” compared to 56 percent in 2020.

“The concerns expressed by survey respondents reflect another year of challenges for the U.S. banking industry as it navigates through the pandemic—and the evolving regulatory and risk landscape,” said Steven Meirink, Executive Vice President and General Manager for Wolters Kluwer Compliance Solutions. “The industry’s resiliency has enabled it to address these challenges admirably.”