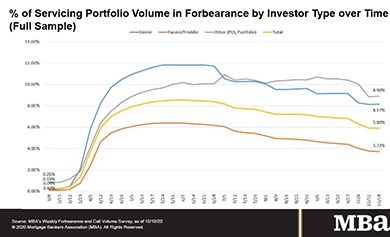

MBA: Share of Mortgage Loans in Forbearance Dips Slightly to 5.90%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 2 basis points to 5.90% of servicers’ portfolio volume as of Oct. 18, from 5.92% the prior week. MBA estimates 3 million homeowners are in forbearance plans.

‘Ghosting’ and ‘Not OK? That’s OK:’ Servicing During a Pandemic

The COVID-19 pandemic has hit borrowers hard. But mortgage servicers are eager to help.

MBA Forecast: 2020 Best Year For Industry Since 2003; 2021 Purchase Originations to Increase to Record $1.54 Trillion

In its latest forecast, the Mortgage Bankers Association said purchase originations are expected to grow by 8.5% to a record $1.54 trillion in 2021. And after a substantial 70.9% jump in activity in 2020, MBA anticipates refinance originations to slow next year, decreasing by 46.3% to $946 billion.

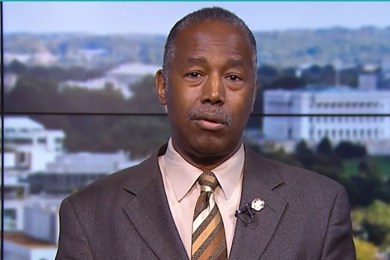

Carson: FHA Will Extend Forbearance Requests Through Year-End

HUD Secretary Ben Carson announced the Federal Housing Administration will extend the date for single-family homeowners with FHA-insured mortgages to request an initial forbearance from their mortgage servicer for up to six months.

GSE Executives Discuss Pandemic Response, Defend New Refinance Fee

The government-sponsored enterprises have supported and provided critical liquidity to the market throughout the COVID-19 pandemic, Fannie Mae and Freddie Mac executives said.