TransUnion, Chicago, Ill., released its Q3 2023 Quarterly Credit Industry Insights Report, finding higher interest rates and prices for goods have pushed credit balances up. Simultaneously, mortgage originations–and other new credit accounts such as automobile loans–are lagging last year.

Category: News and Trends

Nexval’s Souren Sarkar: Why to Transform Engagements With Distressed Borrowers, and How

Upgrading borrower communications represents a golden opportunity for lenders to harness new business channels and technologies that can make their entire operations run more efficiently.

Servicing Quote Tuesday, Nov. 14, 2023

“The national mortgage delinquency rate increased in the third quarter from the record survey low reached in the second quarter of this year, with an uptick in delinquencies across all loan types–conventional, FHA, and VA.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis

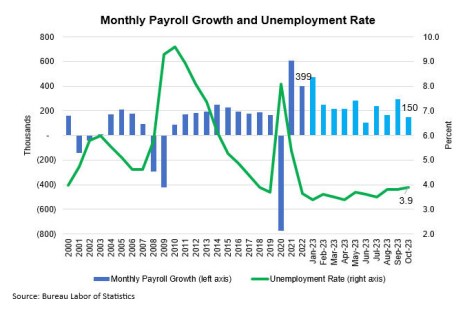

U.S. Payroll Up 150,000 in October, Shows Signs of Weakening

The U.S. economy added 150,000 nonfarm employment jobs in October, the U.S. Bureau of Labor Statistics reported.

ATTOM: Equity-Rich Portion of Mortgaged Homes Slips at Fastest Pace in At Least Four Years

Just over 47% of mortgaged residential properties in the U.S. were considered “equity-rich” in the third quarter, decreased from 49.2% in the second quarter, according to ATTOM, Irvine, Calif.

MBA Chart of the Week: Monthly Payroll Growth and Unemployment Rate

This week’s Chart of the Week highlights the October Employment Situation results released Friday.

Pamela Hamrick of Incenter Diligence Solutions: Elevating QC to a Growth Leader

Just before Labor Day, Fannie Mae instituted new prefunding quality control review requirements, leading to larger discussions of the financial impact of QC processes on mortgage lenders. MBA NewsLink asked Pamela Hamrick, President, Incenter Diligence Solutions, to elaborate.

To the Point With Bob: FSOC’s Bid to Regulate Non-Bank Firms Will Harm Consumers, Mortgage Sector

This spring, the Financial Stability Oversight Council (FSOC) issued a proposal that would remove procedural requirements and allow it to fast-track the designation of non-bank financial companies as systemically important financial institutions (“SIFI”) subject to enhanced supervision by the Federal Reserve.

Servicing Quote Tuesday, Nov. 7, 2023

“The fourth quarter data should say more about whether residential equity in the U.S. has indeed topped out..”

–ATTOM CEO Rob Barber

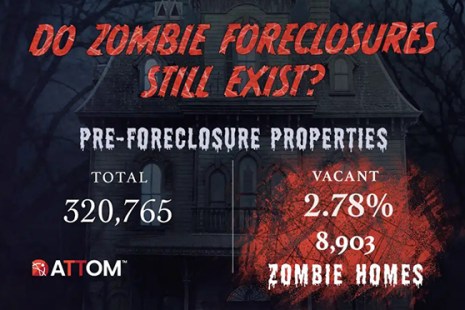

‘Zombie’ Foreclosures Rise as Lenders Pursue More Delinquent Mortgages: ATTOM

Nearly 1.3 million residential properties in the United States are vacant, according to ATTOM, Irvine, Calif.