‘Zombie’ Foreclosures Rise as Lenders Pursue More Delinquent Mortgages: ATTOM

(Image courtesy of ATTOM)

Nearly 1.3 million residential properties in the United States are vacant, according to ATTOM, Irvine, Calif.

That figure represents 1.27%, or one in 78 homes, across the nation–virtually unchanged from the third quarter, ATTOM said in its fourth-quarter 2023 Vacant Property and Zombie Foreclosure Report.

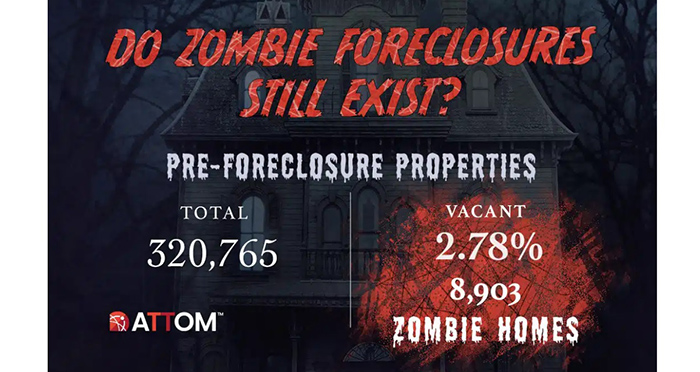

The report said 320,765 residential properties in the U.S. are in the process of foreclosure during the fourth quarter, up 1.7% from the third quarter of 2023 and up 12.8% from a year ago. “A growing number of homeowners have faced possible foreclosure following the nationwide moratorium on lenders pursuing delinquent homeowners was imposed after the Coronavirus pandemic hit in early 2020 and was lifted in the middle of 2021,” ATTOM said.

Among those pre-foreclosure properties, about 8,900 sit vacant as pre-foreclosure properties abandoned by owners, called “zombie foreclosures.” That figure is up 1.4% from the prior quarter and up 15.3% from a year ago. The latest increase marks the seventh straight quarterly rise, the report said.

However, the fourth-quarter count of zombie properties represents only a tiny portion of the nation’s total housing stock–just one of every 11,412 homes around the U.S.

“The ongoing strength of the U.S. housing market continues to benefit neighborhoods around the country in so many ways, with the near-total lack of zombie foreclosures standing out as one striking example,” ATTOM CEO Rob Barber noted. “Rising equity flowing from rising home values has not only kept foreclosure cases from spiking since the moratorium was lifted. It also keeps giving delinquent homeowners a valuable resource they can use to either stave off eviction or sell their homes and move on. As a result, we continue to see none of the widespread abandonment that followed the housing market crash after the Great Recession of the late 2000s.”

Barber said the stable number of zombie properties has come as the U.S. housing market has rebounded from a temporary setback last year.

The nationwide median home value grew 11% during the Spring-Summer buying season this year, hitting a new record of $350,000. Those gains followed an 8 % decline from mid-2022 into early 2023, ATTOM said. The growth in values has helped keep homeowner wealth at historic highs, with 95% of mortgaged owners having at least some equity built up and about 50% owing less than half the estimated value of their properties.

While most neighborhoods around the U.S. have few or no zombie foreclosures, the biggest increases from the third quarter of 2023 to the fourth quarter of 2023 in states with at least 50 zombie properties are in Kentucky (zombie properties up 15%, from 53 to 61), Connecticut (up 15%, from 87 to 100), Maryland (up 13%, from 229 to 258), Texas (up 13%, from 112 to 126) and California (up 12%, from 244 to 274).