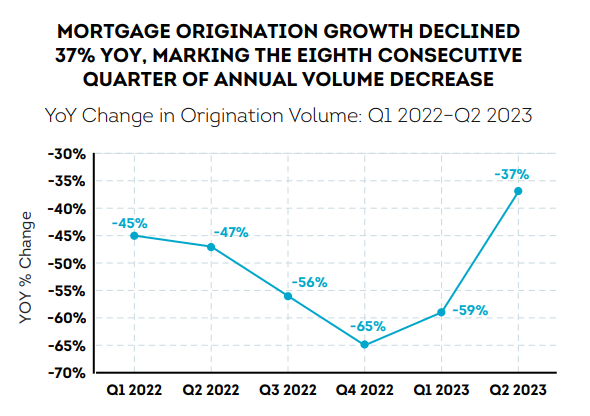

TransUnion: Mortgage Originations Down Almost 37% in Third Quarter Amid Higher Credit Balances

(Image via TransUnion)

TransUnion, Chicago, Ill., released its Q3 2023 Quarterly Credit Industry Insights Report, finding higher interest rates and prices for goods have pushed credit balances up. Simultaneously, mortgage originations–and other new credit accounts such as automobile loans–are lagging last year.

Bankcard balances set a new record at the end of the third quarter, at $995 billion. Last year that figure stood at $866 billion.

The average balance per consumer was up 11% to $6,088–the highest per-customer amount in the past decade.

“Inflation has abated to a large extent in recent months, but its elevated levels in 2021-2022 have left overall prices sharply higher across a wide range of products and services–not just discretionary spend categories, but everyday items that consumers rely on,” said Charlie Wise, Senior Vice President and Head of Global Research and Consulting at TransUnion. “As a result, consumers have increasingly turned to their existing available credit lines. It will be worth watching how those balances are further impacted as some consumers begin feeling the pinch of the resumption of student loan payments.”

Amid the pricier environment, mortgage originations in the quarter were down 36.5% year-over-year. Auto originations were down 8.7% and unsecured personal loan originations were down 14.5%.

Total mortgage balances, however, increased 3.2%–from $11.5 trillion to $11.8 trillion. That’s also slightly up from Q2, when they stood at $11.7 trillion.

Refinances were down 64% year-over-year from 425,000 to 151,000; rate and term and cash-out refinance originations fell 63% and 65% year-over-year, respectively.

Tappable homeowner equity was up 1% year-over-year to $19.7 trillion.

HELOC originations were down 28% from last year. Home Equity loan originations fell 3%.

Mortgage account-level delinquencies did rise 15% year-over-year to 1.02%, but those also remain below historical standards.

“Following a period of historically low account delinquencies, delinquencies have seen six consecutive quarters of [year-over-year] increases–inching them closer to pre-pandemic levels. Delinquencies increased across all stages (early, mid and late) and all loan types,” said Joe Mellman, Senior Vice President and Mortgage Business Leader at TransUnion.

“Vintage performance, which reflects the performance of an account in different periods after the loan was granted, shows deterioration in more recent originations,” Mellman continued. “New mortgage vintages are performing worse than vintages of the past four years. In the midst of increasing non-mortgage debt and rising delinquencies across the board, the record levels of equity available to homeowners will remain a viable solution to ease debt pressures.”