The Community Reinvestment Act was enacted to encourage banks to help meet the credit needs in the communities in which they do business, especially low- and moderate-income communities. Join MBA Education and industry experts on Nov. 28 for an in-depth discussion on the primary changes Agencies made to the NPR in the final regulations.

Category: News and Trends

Servicing Quote Tuesday, Nov. 21, 2023

“Forbearance is still an option for many distressed homeowners, but in most cases, the requirements to obtain a forbearance will not be as streamlined as they were during the pandemic.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis

Planet Home Lending’s Chris Joles: Climate Risk and Impending Alterations in Hazard Insurance and the Subsequent Impact on Mortgage Banking

The evolving landscape of climate risk and hazard insurance is poised to usher in substantial changes that promise to affect all stakeholders in the mortgage industry.

MBA Chart of the Week: Delinquency Rates by Loan Type, Conventional, FHA, VA

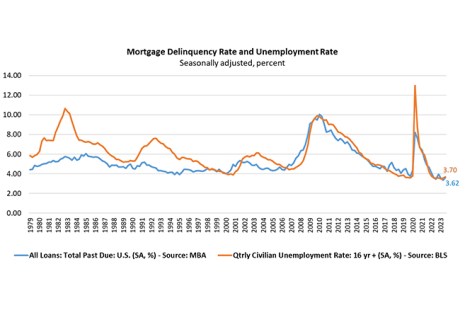

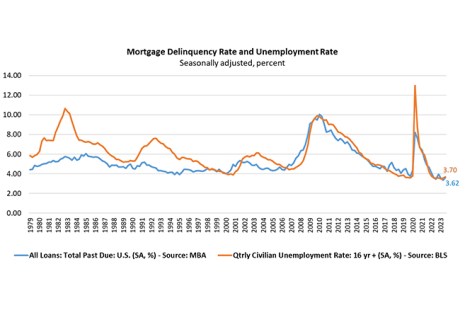

According to the latest MBA National Delinquency Survey, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to 3.62% of all loans outstanding at the end of the third quarter of 2023.

MBA: Mortgage Delinquencies Increase in the Third Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.62% of all loans outstanding at the end of the third quarter of 2023, according to the Mortgage Bankers Association’s National Delinquency Survey.

MISMO Seeks Public Comment on Updated Engineering Guidelines

MISMO, the real estate finance industry’s standards organization, announced that it is seeking public comment on the updated MISMO Engineering Guideline (MEG) 7. The 30-day public comment period runs through Dec. 8, 2023.

TransUnion: Mortgage Originations Down Almost 37% in Third Quarter Amid Higher Credit Balances

TransUnion, Chicago, Ill., released its Q3 2023 Quarterly Credit Industry Insights Report, finding higher interest rates and prices for goods have pushed credit balances up. Simultaneously, mortgage originations–and other new credit accounts such as automobile loans–are lagging last year.

Nexval’s Souren Sarkar: Why to Transform Engagements With Distressed Borrowers, and How

Upgrading borrower communications represents a golden opportunity for lenders to harness new business channels and technologies that can make their entire operations run more efficiently.

Servicing Quote Tuesday, Nov. 14, 2023

“The national mortgage delinquency rate increased in the third quarter from the record survey low reached in the second quarter of this year, with an uptick in delinquencies across all loan types–conventional, FHA, and VA.”

–Marina Walsh, CMB, MBA’s Vice President of Industry Analysis

U.S. Payroll Up 150,000 in October, Shows Signs of Weakening

The U.S. economy added 150,000 nonfarm employment jobs in October, the U.S. Bureau of Labor Statistics reported.