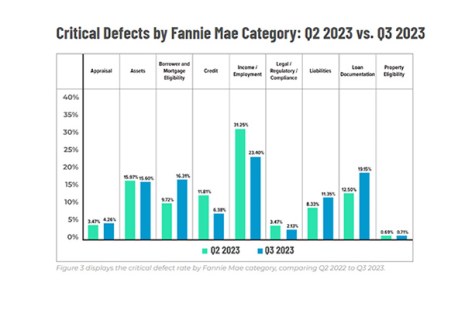

“One area of the mortgage lending market is strong–and that is defect performance. Despite rate and volume concerns, critical defect rates are down for the fourth straight quarter.”

–Nick Volpe, Executive Vice President of ACES Quality Management

“One area of the mortgage lending market is strong–and that is defect performance. Despite rate and volume concerns, critical defect rates are down for the fourth straight quarter.”

–Nick Volpe, Executive Vice President of ACES Quality Management

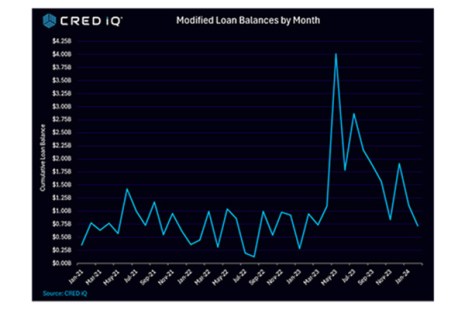

CRED iQ, Wayne, Pa., reported the number of commercial loan modifications jumped significantly in 2023 from 2022. And, the firm anticipates that trend will persist in 2024.

MISMO®, the real estate finance industry’s standards organization, is seeking public comment on two issues, the previously published IRS 4506-C dataset and the Ability to Repay Decision Model and Notation white paper.

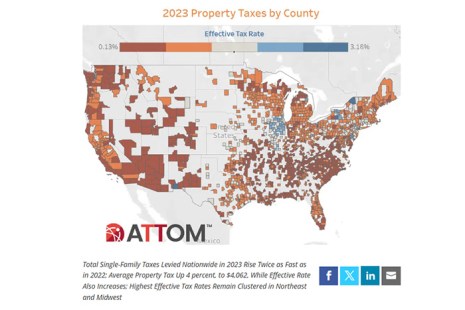

ATTOM, Irvine, Calif., released an analysis of property taxes across the U.S., finding that there was a 6.9% increase in overall property taxes levied in 2023 from 2022.

ACES Quality Management, Denver, found the overall critical defect rate continued to fall in Q3 2023, by 2.91% to 1.67%.

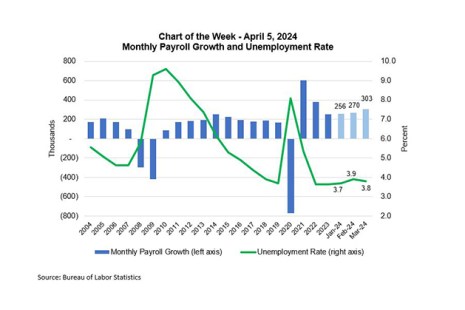

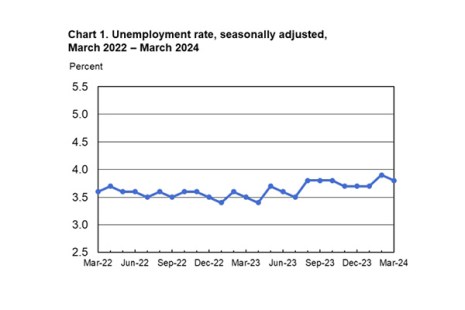

Our Chart of the Week focuses on Friday’s Employment Situation report released by the Bureau of Labor Statistics.

Total nonfarm payroll employment grew by 303,000 in March, per the U.S. Bureau of Labor Statistics.

“Nationwide, the overall mortgage delinquency rate held steady in January, and the serious delinquency rate fell from a year ago,”

–Molly Boesel, principal economist with CoreLogic

CoreLogic, Irvine, Calif., said the U.S. housing market posted an overall delinquency rate of 2.8% in January, approaching a record low.

RealPage, Richardson, Texas, found more than 75% of survey participants report an increase in rental fraud in their multifamily communities in the past year.