Federal Housing Finance Agency Mark Calabria yesterday told MBA members that the agency wants comments on a proposed rule that would require Fannie Mae and Freddie Mac to obtain approval for new products and notice before engaging in new activity.

Category: News and Trends

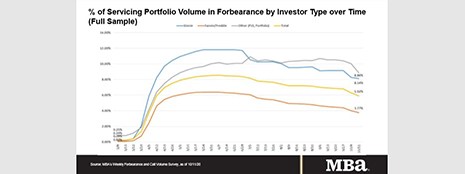

MBA: Share of Mortgage Loans in Forbearance Falls to 5.92%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 40 basis points to 5.92% of servicers’ portfolio volume as of October 11, from 6.32% the prior week. MBA now estimates 3 million homeowners are in forbearance plans.

Quote

“There is growing concern that absent a slowdown in the number of coronavirus cases and another round of much-needed federal aid, millions of renters in the coming months face the prospects of falling further behind.”

–Gary V. Engelhardt, Professor of Economics in the Maxwell School of Citizenship and Public Affairs at Syracuse University and co-author of a Research for Housing Institute America study on financial distress during the coronavirus pandemic.

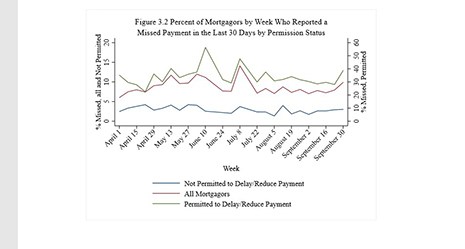

RIHA Study: More than 6 Million Renters and Homeowners and 26 Million Student Debt Borrowers Missed September Payment

More than six million households did not make their rent or mortgage payments, and 26 million individuals missed their student loan payment in September, according to third quarter research released by the Mortgage Bankers Association’s Research Institute for Housing America.

CMBS Servicers Working through Surge in Requests

S&P Global Ratings, New York, said commercial mortgage-backed securities special servicers are working through a surge in borrower requests for relief, primarily on lodging and retail properties.

ATTOM: Foreclosure Activity at Historic Lows as Moratorium Stalls Filings

ATTOM Data Solutions, Irvine, Calif., reported just 27,016 properties with foreclosure filings in the third quarter, down by 12 percent from the previous quarter and down by 81 percent from a year ago to the lowest level since it began tracking quarterly filings in 2008.

Women in Leadership: An Interview with Cristy Ward of Mortgage Connect

Cristy and I sat down on October 13 and discussed the current state of the market and the trends we are observing in default management servicing.

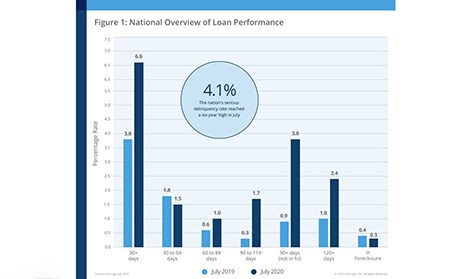

CoreLogic: Serious Delinquencies Spiking Despite Strong Housing Demand

CoreLogic, Irvine, Calif., reported an increase in overall mortgage delinquency rates in July—and in particular, a spike in serious delinquencies to their highest level in more than six years.

National Association of Insurance Commissioners Adopts MBA/ACLI Proposals

A National Association of Insurance Commissioners working group adopted risk-based capital guidance and reporting instructions to implement the Mortgage Bankers Association/American Council of Life Insurers-proposed Risk-Based Capital reporting of 2020 Net Operating Income.

MBA Urges FHFA to Extend Current GSE Affordable Housing Goals

The Mortgage Bankers Association, in a letter this morning to the Federal Housing Finance Agency, said FHFA should extend current affordable housing goals for Fannie Mae and Freddie Mac, given current economic uncertainty.