Housing markets along the East Coast and in Illinois were most vulnerable to damage from the Coronavirus pandemic in the second quarter, reported ATTOM, Irvine, Calif.

Category: News and Trends

Quote

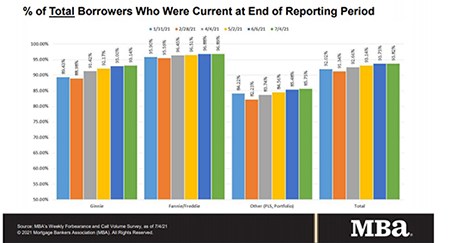

“As is typical for mid-month reporting, forbearance exits slowed, and there was a slight increase in new requests. The net result was a small drop in the share of loans in forbearance – the 21st consecutive week of declines.”

–MBA Chief Economist Mike Fratantoni.

Murali Tirupati: How Mortgage Servicers Can Improve Operations with an ‘Automation-First’ Strategy

mortgage servicers are under tremendous pressure to not just onboard loan files faster but do so in compliance with regulatory requirements of CFPB.

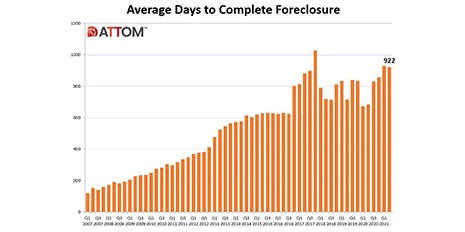

Foreclosure Filings at Record Low

ATTOM, Irvine, Calif., reported a record-low 65,082 U.S. properties with foreclosure filings in the first six months of 2021, down 61 percent from a year ago and down 78 percent from two years ago.

CMBS Delinquency, Special Servicing Rates Improve

Trepp LLC, New York, reported the commercial mortgage-backed securities delinquency rate declined again in June–but not by much.

MBA CONVERGENCE Takes Big Next Step in Columbus

MBA CONVERGENCE, the Mortgage Bankers Association’s initiative to promote minority homeownership opportunities, launches its second major pilot program July 21 in Columbus, Ohio.

Quote

“Forbearance exits edged up again last week and new forbearance requests dropped to their lowest level since last March, leading to the largest weekly drop in the forbearance share since last October and the 20th consecutive week of declines.” –Mike Fratantoni, MBA Senior Vice President and Chief Economist.

Jennifer Henry: The Role Third-Party Data Plays for Mortgage Originators and Servicers

Lenders and servicers alike must focus on streamlining processes through automated technology and data-enabled solutions to sustain a more profitable business model and manage the shifts and demands of the marketplace.

Share of Mortgage Loans in Forbearance Decreases to 3.76%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 11 basis points to 3.76% of servicers’ portfolio volume as of July 4 from 3.87% the week before,–the 19th consecutive weekly decline. MBA estimates 1.9 million homeowners are in forbearance plans.

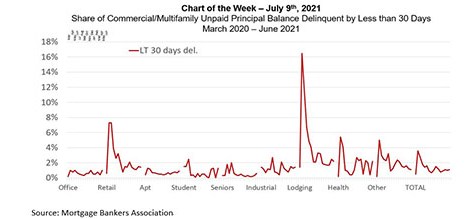

MBA Chart of the Week, July 13, 2021: Commercial/Multifamily Delinquencies

When looking at commercial and multifamily mortgage delinquency rates, we tend to exclude loans that have been delinquent for less than 30 days, as many may be experiencing a temporary “hiccup” that will be quickly remedied before the next payment is due. But examining these rates can provide key insights into commercial and multifamily mortgage performance through the pandemic and into today.