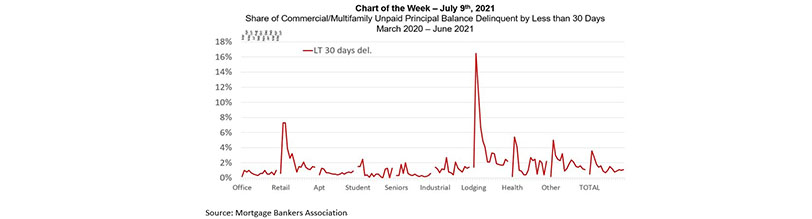

MBA Chart of the Week, July 13, 2021: Commercial/Multifamily Delinquencies

When looking at commercial and multifamily mortgage delinquency rates, we tend to exclude loans that have been delinquent for less than 30 days, as many may be experiencing a temporary “hiccup” that will be quickly remedied before the next payment is due. But examining these rates can provide key insights into commercial and multifamily mortgage performance through the pandemic and into today.

First, the share of loan balances that are less than 30 days late shows the onset of the COVID-19 pandemic last spring brought a sharp shock to commercial real estate markets, and to some of the mortgage loans backed by income-producing properties. The shock was most profound for lodging and retail properties and was far more muted for other property types like office, apartment and industrial.

Second, the flow of newly delinquent loans slowed dramatically after the first few months, with the share of lodging loan balances less than 30 days dropping from 16.5% in April 2020 to 11.9% in May, to 6.7% in June and 4.9% in July. Note that many of these loans moved on to being 30-60, 60-90 and 90+ days delinquent, with the share of lodging loans that were 90+ days delinquent growing from 2.1% in June 2020 to 9.7% in July, and then 12.3% in August and 13.6% in September.

Third, even with the economic impacts of the pandemic waning, inflows of newly delinquent loans remain (marginally) above pre-pandemic levels. Some of this stems from the fact that the economy — while much improved — continues to see stress in some areas: some from the fact that for certain property types, longer lease terms mean that financial impacts of economic events can be delayed; and some from the fact that delinquency rates prior to the pandemic were at extraordinarily low levels and were expected to climb even without a major economic weakening.

More than a year after the onset of the pandemic, commercial and multifamily mortgage delinquency rates are being driven by loans that missed their first payments months ago and are now 90+ days late and the subject of workouts by lenders and servicers. While the inflow of newly delinquent loans has fallen dramatically from the depths of the pandemic, they will continue to be an important bellwether for the market.

–Jamie Woodwell jwoodwell@mba.org.