Foreclosure Filings at Record Low

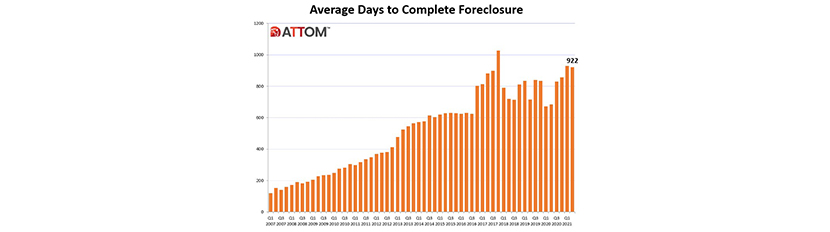

(Chart courtesy ATTOM.)

ATTOM, Irvine, Calif., reported a record-low 65,082 U.S. properties with foreclosure filings in the first six months of 2021, down 61 percent from a year ago and down 78 percent from two years ago.

“The government’s foreclosure moratorium and mortgage forbearance program have created an unprecedented situation – historically high numbers of seriously delinquent loans and historically low levels of foreclosure activity,” said Rick Sharga, executive Vice President of RealtyTrac, an ATTOM company. “With the moratorium scheduled to end on July 31, and half of the remaining borrowers in forbearance scheduled to exit that program over the next six months, we should start to get a more accurate read on the level of financial distress the pandemic has caused for homeowners across the country.”

Key report findings:

–Nationwide, just 0.05 percent of all housing units (one in every 2,112) had a foreclosure filing in the first half of 2021. States with the highest foreclosure rates in the first half of 2021 were Delaware (0.10 percent); Illinois (0.09 percent); Florida (0.08 percent); Ohio (0.08 percent); and Indiana (0.08 percent).

–Among 220 metropolitan statistical areas with a population of at least 200,000, those with the highest foreclosure rates in the first half of 2021 were Lake Havasu, Ariz. (0.25 percent); Cleveland, Ohio (0.15 percent); Macon, Ga. (0.13 percent); Peoria, Ill. (0.12 percent); and Florence, S.C. (0.12 percent).

–36,742 U.S. properties started the foreclosure process in the first six months of 2021, down 63 percent from the first half of last year but up 14 percent from the last half of 2020. States that saw the greatest decline in foreclosure starts from the same time last year included, Maryland (down 95 percent); Oklahoma (down 87 percent); Pennsylvania (down 81 percent); Idaho (down 78 percent); and New Mexico (down 76 percent).

–Lenders foreclosed on 9,730 U.S. properties in the first six months of 2021, down 74 percent from a year ago to the lowest six-month total since ATTTOM began tracking in 2005.

“Fewer bank repossessions may be a trend we continue to see even after the government’s programs protecting borrowers from foreclosure expire,” Sharga said. “Rising home prices have provided most homeowners with enough equity to sell their homes at a profit, rather than lose them to a foreclosure or repossession.”

— 33,964 U.S. properties with foreclosure filings in the second quarter, up less than 1 percent from the previous quarter and up 11 percent from a year ago.

–The national foreclosure activity total in the second quarter was 88 percent below the pre-recession average of 278,912 per quarter from Q1 2006 to Q3 2007, making it the 19th consecutive quarter with foreclosure activity below the pre-recession average.

–Properties foreclosed in the second quarter took an average of 922 days from the first public foreclosure notice to complete the foreclosure process, down slightly from 930 days in the previous quarter but down from 685 days in second quarter 2020.

–States with the longest average foreclosure timelines for foreclosures completed in the second quarter were Hawaii (3,068 days), New York (1,822 days), Indiana (1,617 days), Wisconsin (1,587 days) and New Jersey (1,471 days). States with the shortest average foreclosure timelines for foreclosures completed were Wyoming (173 days), Arkansas (253 days), Tennessee (270 days), Virginia (280 days) and Mississippi (292 days).

–Nationwide in June, one in every 10,547 properties had a foreclosure filing.

–States with the highest foreclosure rates in June were Nevada (one in every 3,959 housing units); Delaware (one in every 5,700); Illinois (one in every 5,923); South Carolina (one in every 5,971); and New Jersey (one in every 6,367).

–6,826 U.S. properties started the foreclosure process in June, up 16 percent from the previous month and up 40 percent from a year ago.

–Lenders completed the foreclosure process on 2,311 U.S. properties in June, up 76 percent from the previous month but down 8 percent from a year ago.