The Consumer Financial Protection Bureau and the Department of Justice on Monday issued two joint letters Monday on legal housing protections for military families.

Category: News and Trends

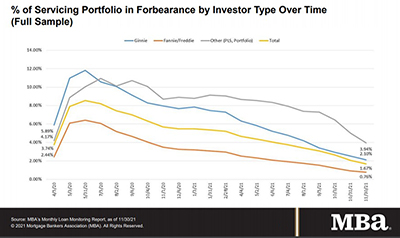

MBA Loan Monitoring Survey: Mortgage Loans in Forbearance Fall to 1.67%

The Mortgage Bankers Association’s new monthly Loan Monitoring Survey reported loans now in forbearance decreased by 39 basis points to 1.67% of servicers’ portfolio volume as of November 30 from 2.06% in October. MBA estimates 835,000 homeowners remain in forbearance plans.

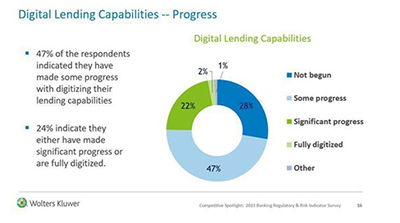

Survey Details Lenders’ ‘Substantial’ Risk, Compliance Concerns

Regulatory compliance and risk concerns remain elevated in a number of key areas for U.S. banks and credit unions, according to results of Wolters Kluwer’s 2021 Regulatory & Risk Management Indicator survey.

FHFA Proposes Capital Planning Rule for Fannie Mae, Freddie Mac

The Federal Housing Finance Agency issued a proposed rule on Thursday that would require Fannie Mae and Freddie Mac to develop, maintain and submit annual capital plans.

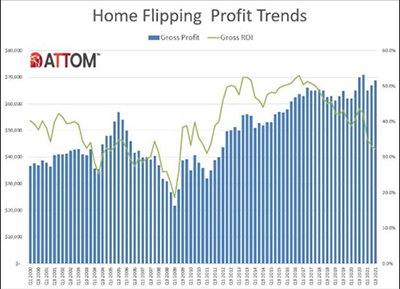

3Q Home Flipping Profit Margins Drop to 10-Year Low

ATTOM, Irvine, Calif., said home-flipping became more popular in the third quarter—but it wasn’t as profitable.

Senate Approves Alanna McCargo as Ginnie Mae President

The Senate on Tuesday approved Alanna McCargo as President of Ginnie Mae by voice vote.

Federal Agencies Make No Changes to QRM Definition

Six federal agencies issued notice on Tuesday that they will not modify their current definition of a Qualified Residential Mortgage.

MBA: 3Q Holdings of Commercial/Multifamily Mortgage Debt Increase

Commercial/multifamily mortgage debt outstanding increased by $64.8 billion (1.6 percent) in the third quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Mortgage Debt Outstanding report.

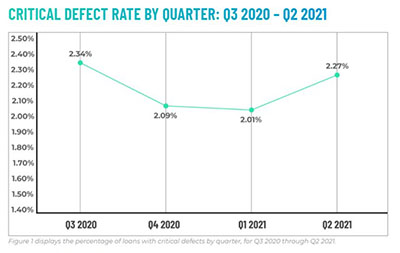

ACES: Q2 Critical Defect Rate Up 13%

ACES Quality Management, Denver, reported a13% increase in overall critical defect rates to 2.27%, ending a multi-quarter trend of improvement.

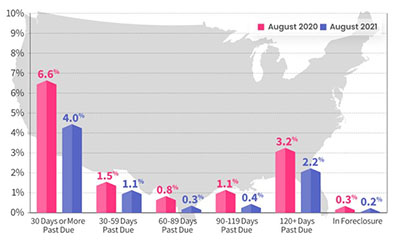

Mortgage Delinquency Declines Approach Pre-Pandemic Levels

As home equity continues to soar, mortgage delinquency rates fell to levels not seen since onset of the coronavirus pandemic, said CoreLogic, Irvine, Calif.