The Mortgage Bankers Associations Servicing Solutions Conference & Expo, Roadmap to Servicing Success, takes place Feb. 21-24 at the Hyatt Regency Orlando.

Category: News and Trends

Quote

“While servicing technology has evolved over the last several years, broadly speaking the industry has under-invested in technology. Just look at how much capability you have in your smartphone. We need more technology.”

–Bob Caruso, CEO of ServiceMac LLC, Fort Mill, S.C.

Cash-Outs, Purchase Locks Decline Amid Record-Low Affordability

Black Knight, Jacksonville, Fla., said cash-out refinances fell significantly in September, by 26.2 percent from August alone and by 78 percent from a year ago. A similar report from MCT, San Diego, also found a sharp drop in loan lock volume in September.

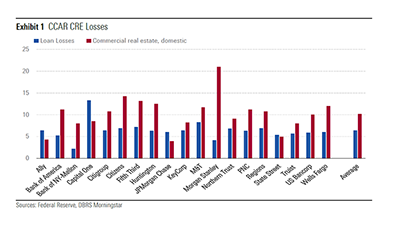

DBRS Morningstar: Federal Reserve Finds CRE Risk

The good news: all 34 banks the Federal Reserve’s recent stress tests examined passed. The not-so-good news: the tests found potential risks in certain loan portfolios including commercial real estate, said DBRS Morningstar, New York.

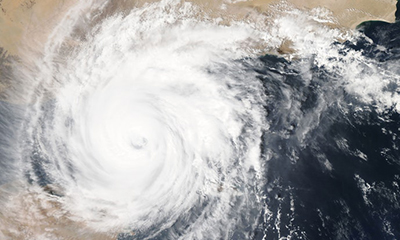

CoreLogic: Insured, Uninsured Damages for Hurricane Ian at $41-$70 Billion

CoreLogic, Irvine, said final damage estimates for Hurricane Ian could run as high as $70 billion—of which up to $17 billion could be uninsured.

Call for Speakers: MBA Servicing Solutions Conference & Expo: Deadline Oct. 14

Speaking opportunities for breakout sessions continue to be accepted for The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2023, taking place February 21–24 at Hyatt Regency Orlando.

Quote

“Housing markets in Florida will face difficult times as many Florida residents have been impacted by the devastating storm. Initially, we are likely to see an increase in mortgage delinquencies as is typical following catastrophes. Also, rents are likely to jump as households who lost their home seek immediate shelter. Longer term, home price growth in hard hit areas is likely to lag that of the rest of the state and nation as people may opt to move to areas less prone to natural disasters.”

–Selma Hepp, interim lead of the Office of the Chief Economist with CoreLogic, Irvine, Calif.

Typical Homebuyer’s Mortgage Payment Up 15% Since Mid-August

Talk about a wallop to the wallet: the typical homebuyer’s monthly mortgage payment has climbed $337 (15%) over the past six weeks, according to a report from Redfin, Seattle.

Staying Put: 85% of Homeowners with Mortgages Have Rate Far Below Current Level

With mortgage interest rates pushing well above 6 percent—even approaching 7 percent—a growing number of homeowners are reluctant to sell because they have a lower rate locked in, said Redfin, Seattle.

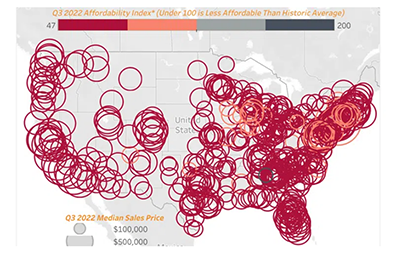

ATTOM: Homeownership Still Unaffordable Across Most of U.S.

Median-priced single-family homes and condos remain less affordable in the third quarter compared to historical averages in nearly all U.S. counties, reported ATTOM, Irvine, Calif.