DBRS Morningstar: Federal Reserve Finds CRE Risk

The good news: all 34 banks the Federal Reserve’s recent stress tests examined passed. The not-so-good news: the tests found potential risks in certain loan portfolios including commercial real estate, said DBRS Morningstar, New York.

“While the most recent round of Federal Reserve stress testing showed all banks subject to the tests readily passing, they also highlighted potential risks in certain loan portfolios including commercial real estate,” said John Mackerey, Senior Vice President with DBRS Morningstar.

In its report, Federal Reserve Stress Tests Highlight CRE Risk, DBRS noted the Fed’s Comprehensive Capital Analysis and Review stress tests evaluate banks’ resilience to a severe hypothetical downturn. The most recent stress test scenarios included a severe global recession accompanied by heightened stresses in commercial real estate including a 40% decline in CRE prices. DBRS said the stresses hit the hospitality, retail and office property types the hardest.

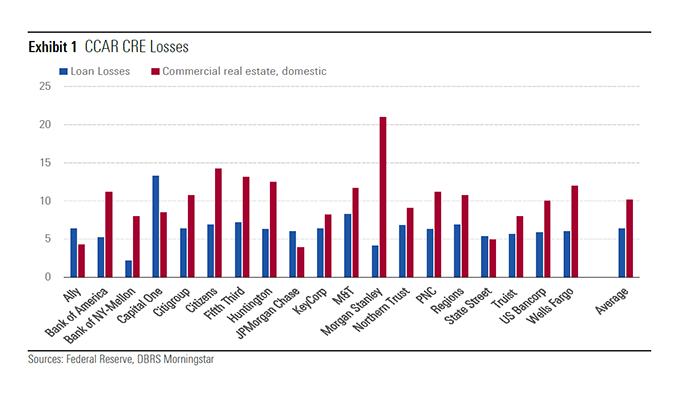

Loan losses totaled $463 billion during the stress test, though losses varied significantly across the 34 banks tested. “Additionally, while commercial real estate losses accounted for 16% of total loan losses, the loss rates on these loans were the second-highest next to credit cards compared to all loan categories,” DBRS said.

Looking at just the 20 publicly traded U.S. banks with commercial real estate exposure, CRE losses represented 10.7% of the CRE loan portfolio compared with 6.5% of losses over the total portfolio, the report said. Losses ranged from 21% for Morgan Stanley to 3.9% for JPMorgan Chase. Just eight banks had losses under 10%. This higher level of potential loan losses highlights the risks inherent in CRE lending DBRS said.

“We do take comfort that the banks were able to absorb the losses resulting from a severe stress scenario and that, in general, banks have lowered their exposure to CRE loans post financial crisis,” DBRS said. “Additionally, some banks have taken additional steps to reduce on-balance sheet exposure to CRE through securitization or other transfers of credit risk. We do also note that banks’ own stress testing may come up with vastly different results and nuances in underwriting and strong historical track records may not be fully captured by the Comprehensive Capital Analysis and Review stress test.”