ATTOM: Homeownership Still Unaffordable Across Most of U.S.

Median-priced single-family homes and condos remain less affordable in the third quarter compared to historical averages in nearly all U.S. counties, reported ATTOM, Irvine, Calif.

That figure remains far above the 69 percent of counties that were historically less affordable in third quarter 2021 and marked yet another high point reached during the country’s 11-year housing market boom.

But the third-quarter U.S. Home Affordability Report also found some potential relief for homebuyers as the portion of average wages nationwide required for median major home-ownership expenses has dipped slightly from 30.9 percent in the second quarter of the year to 30 percent in the third quarter.

“Homeownership remains largely unaffordable for the majority of homebuyers in the majority of markets across the country,” said Rick Sharga, Executive Vice President of Market Intelligence with ATTOM. “While home prices have declined a bit quarter-over-quarter, they’re still higher than they were a year ago, and interest rates have essentially doubled. Many prospective homebuyers simply can’t afford the home they hoped to buy, and in many cases no longer qualify for the mortgage they’d need.”

ATTOM noted the third-quarter figure remains above the 28 percent ceiling lenders generally like to see when issuing a mortgage and well above the 23.4 percent level from a year ago. But it said the current decline in the portion of wages needed to afford the typical home nationwide marks the first quarterly improvement in almost two years and comes as the median national single-family home price has taken a rare third-quarter fall. The latest median value of $340,000 is down 3 percent from second-quarter 2022–the first Spring-to-Summer decline since 2008.

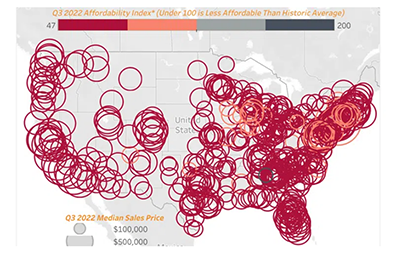

Compared to historical levels, median home prices in 574 of the 581 counties analyzed in the third quarter are less affordable than in the past. The latest number is up from 568 of the same group of counties in the second quarter of 2022, 398 in the third quarter of 2021 and just 284, or less than half, two years ago. The increase has continued as the median national home price–despite dipping quarterly–is still up 10 percent over the past year, while average annual wages across the country have grown just 6 percent.