FundingShield, Newport Beach, Calif., released its Q3 Wire Fraud Analytics and Risk Report, finding that nearly 46.6% of transactions were flagged for issues posing significant wire and title fraud risks. Each of those loans had an average of 3.1 issues per transaction, a record high and an increase of 35% from Q2.

Category: News and Trends

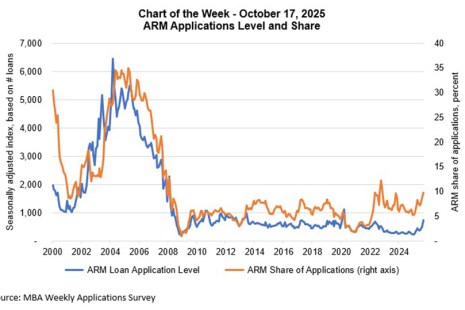

Chart of the Week: ARM Applications Level and Share

Adjustable-rate mortgages (ARMs), when used appropriately, can help ease affordability challenges and provide homeownership and equity building opportunities for qualified borrowers.

Home Sale Profits Up in Third Quarter: ATTOM

Homeowners averaged a 49.9% profit selling single-family homes and condos during the third quarter, according to ATTOM, Irvine, Calif.

MBA Forecast: Total Single-Family Mortgage Originations to Increase 8% to $2.2 Trillion in 2026

The Mortgage Bankers Association announced at its 2025 Annual Convention and Expo that total single-family mortgage origination volume is expected to increase to $2.2 trillion in 2026 from $2.0 trillion expected in 2025.

Bob Broeksmit: ‘MBA Won’t Rest Until GSE Release Is Done Right’

LAS VEGAS–Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, took the stage at the organization’s Annual Convention and Expo, Oct. 20. When it comes to conversations with the administration about GSE reform, “we don’t just have a seat at the table,” said Broeksmit. “We’re near the head of the table–and we’re speaking loud and clear.”

MBA 2026 Chair Christine Chandler: ‘Stronger Together’

LAS VEGAS–We are all stronger when we work together–and we have some amazing opportunities to move forward together, MBA 2026 Chair and Executive Vice President, Chief Credit Officer and Chief Operating Officer with M&T Realty Capital Corp. Christine Chandler said.

MBA Elects 2026 Board of Directors; Announces Governors and Committee Chairs for 2026

The Mortgage Bankers Association (MBA) swore in its Board of Directors for the 2025 membership year at its 2025 Annual Convention and Expo. The Board of Directors will be chaired by Christine Chandler, Executive Vice President, Chief Credit Officer and Chief Operating Officer with M&T Realty Capital Corporation (RCC).

MBA Recognizes 40 New Certified Mortgage Banker Graduates

LAS VEGAS–MBA Education, the award-winning education division of the Mortgage Bankers Association, recognized 40 individuals who earned the Certified Mortgage Banker designation at a ceremony at MBA’s 2025 Annual Convention & Expo. Earning one’s CMB is the highest professional honor within the real estate finance industry.

Marcia Davies on Lessons Learned Over 10 Years of mPower

LAS VEGAS–Marcia Davies, Mortgage Bankers Association chief operating officer, took the stage at mPowering You, MBA’s Summit for Women in Real Estate Finance Oct. 18, to share reflections on her experiences over the past decade.

BatchData.io: Investors Account for One-Third of Second-Quarter Home Purchases

Real estate investors purchased 33% of all single-family residential properties sold in the second quarter–the highest percentage of investor purchases in the last five years–according to BatchData.io, Phoenix.