For those who attended MBA’s Servicing Solutions Conference in February, the unveiling of the delinquency data for the fourth quarter of 2022 caused quite a stir.

Category: News and Trends

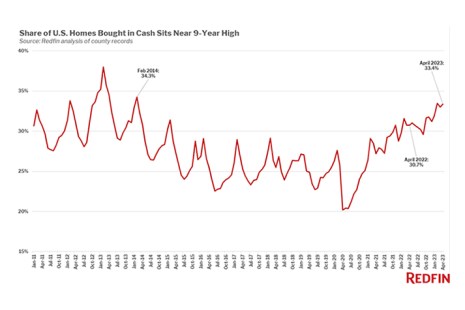

One-Third of Homebuyers Used Cash in April, Redfin Finds

Redfin, Seattle, reported 33.4% of home purchases in April were all-cash, almost the highest share in nine years and up from 30.7% in April 2022.

Commercial Real Estate Reset? A Special Servicing Roundtable

As property sale transactions and originations stall, MBA NewsLink interviewed two special servicing executives and a CMBS researcher to get their insights on the commercial real estate finance landscape and outlook.

Quote: Tuesday, June 13, 2023

“Christine Chandler is a passionate and influential leader in real estate finance and is a terrific choice to lead MBA and its members through the challenges and opportunities our industry faces.”

–Matt Rocco, 2023 MBA Chairman and President of Colliers Mortgage

Be a DEI Champion: Deadline Aug. 4

MBA’s Diversity, Equity and Inclusion Leadership Awards recognize leading organizations who are exhibiting exemplary leadership through their impactful DEI efforts. We want to hear more about your DEI strategy, implementation, …

MBA Launches Upgraded CONVERGENCE Site

The Mortgage Bankers Association announced a revamped version of the CONVERGENCE section of its website, aiming to benefit its members and a broader audience.

MBA Single-Family Research and Economics Showcase 2023 June 21-22

A two-day online event, the MBA Single-Family Research & Economics Showcase highlights the most current results and insights from MBA’s residential surveys, forecasts and reports. Led by MBA Chief Economist …

MBA Education School of Mortgage Servicing Begins July 10

MBA Education presents its School of Mortgage Servicing instructor-guided online course July 10-20. School of Mortgage Servicing presents an overview of the basic servicing functions and the potential compliance risks …

ATTOM: Zombie Foreclosures Increase

Vacant residential properties increased 1.3% in the second quarter to 1.28 million houses, reported ATTOM, Irvine, Calif.

MBA Launches Upgraded CONVERGENCE Site

The Mortgage Bankers Association announced a revamped version of the CONVERGENCE section of its website, aiming to benefit its members and a broader audience.