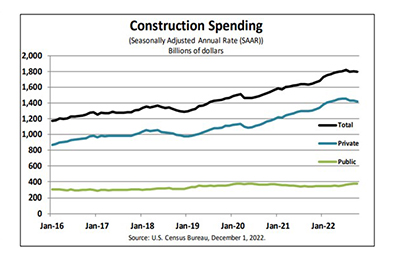

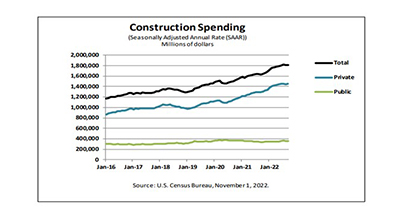

Construction spending dipped in October, the Commerce Department reported Thursday, with slight increase in public construction offset by a decline in private construction. Separately, the Institute for Supply Management, Phoenix, reported its Manufacturing Report on Business fell for the first time in two and a half years.

Tag: Wells Fargo Economics

Jobs Reports: ‘Great Resignation’ Starting to Fade

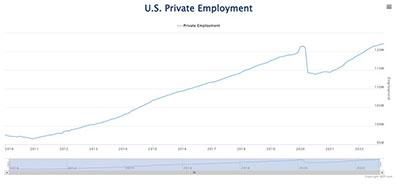

In the first two of four major jobs reports this week, ADP, Roseland, N.J., said private-sector employment slowed to 127,000 jobs in November. And the Bureau of Economic Analysis reported November job openings fell by more than 7 percent from a year ago.

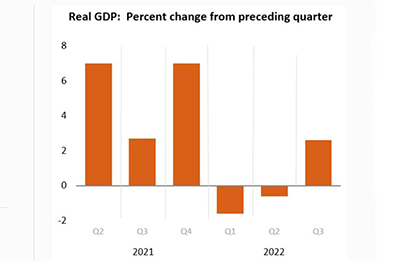

3Q GDP Shows 2.9% Growth

Real gross domestic product increased at an annual rate of 2.9 percent in the third quarter, according to the “second” (revised) estimate released Wednesday by the Bureau of Economic Analysis.

Consumer Confidence Falls to 4-Month Low

The Conference Board, New York, said its Consumer Confidence Index fell in November, its second consecutive monthly drop to its lowest level since August.

Existing Home Sales Fall 9th Straight Month

October existing home sales fell—the ninth consecutive monthly decrease—the National Association of Realtors reported Friday.

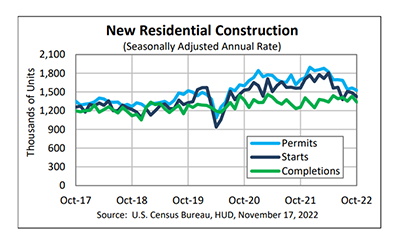

October Housing Starts Down 4.2%

Housing starts fell in October—the third straight monthly decline—but generally beat analysts’ expectations, HUD and the Census Bureau reported Thursday.

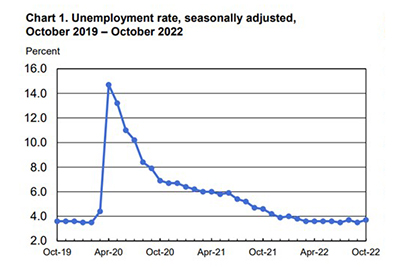

Employers Add 261,000 October Jobs; Unemployment Rate Rises

The Bureau of Labor Statistics on Friday reported employers added 261,000 jobs in October; meanwhile, the unemployment rate ticked up to 3.7 percent.

September Job Openings Surge; Construction up 0.2%

Job openings in September jumped by more than a half-million from August, showing there are 1.9 job openings for every available worker, the Bureau of Labor Statistics said Tuesday in the first of four major jobs reports this week.

Robust Spending Boosts 3Q GDP

After two quarters in negative territory, real U.S. gross domestic product swung positive in the third quarter, according to the first (advance) estimate released by the Bureau of Economic Analysis Thursday.

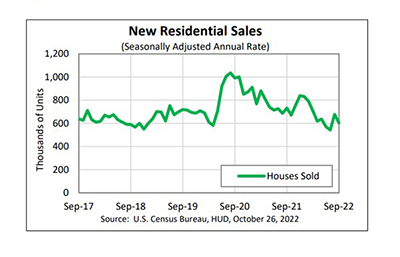

September New Home Sales Down 11%

New home sales fell by nearly 11 percent in September, HUD and the Census Bureau reported Wednesday, as rising interest rates discouraged home buyers.