Employers Add 261,000 October Jobs; Unemployment Rate Rises

The Bureau of Labor Statistics on Friday reported employers added 261,000 jobs in October; meanwhile, the unemployment rate ticked up to 3.7 percent.

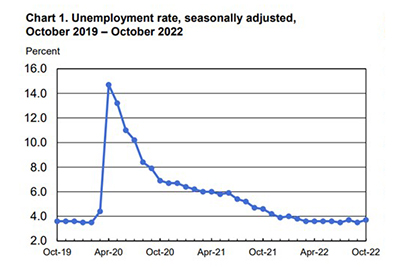

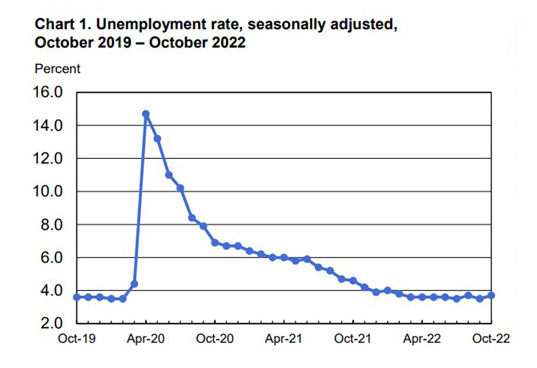

BLS said notable job gains took place in health care, professional and technical services and manufacturing. The unemployment rate increased by 0.2 percentage point, while the number of unemployed persons rose by 306,000 to 6.1 million. The unemployment rate has been in a narrow range of 3.5 percent to 3.7 percent since March.

BLS revised total nonfarm payroll employment for August down by 23,000, from +315,000 to +292,000, and for September was up by 52,000, from +263,000 to +315,000, for a net gain of 29,000.

The labor force participation rate, at 62.2 percent, and the employment-population ratio, at 60.0 percent, were unchanged in October and have shown little net change since early this year. These measures are 1.2 percentage points below their values in February 2020, prior to the coronavirus pandemic.

“Job growth for October was slightly stronger than expected, with a gain of 261,000 jobs. The number of jobs added to the economy did slow from September’s total, but this was still a strong positive gain that kept the monthly average for 2022 at over 400,000 jobs added per month,” said Joel Kan, Vice President and and Deputy Chief Economist with the Mortgage Bankers Association. “Most of the October growth was in the service sector, while the goods producing industries saw the lowest gain since January 2022. Construction employment was essentially flat over the month, consistent with the slowdown in the home building sector.”

Kan noted the rise in the unemployment rate occurred despite a slight decline in labor force participation. “This increase reflects the second time in three months where there has been an uptick in the number of unemployed workers,” he said.

“[Friday’s] report indicates the labor market is slowing a bit, but still not within the Fed’s speed limit,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “When workers are hard to find, employers are less willing to let them go. Data from the Census Bureau’s Household Pulse Survey from mid-October indicates that job losses have continued trending lower. Layoffs in the JOLTS report are similarly below the historical average.”

Kushi noted residential building construction employment increased by a modest 0.3% month over month, while non-residential picked up by 0.4%. Residential building is up 7.7% compared with pre-pandemic levels, while non-residential building remains 4.8% below pre-pandemic levels. “However, the gains were not broadly based,” she said. “Specialty trade contractor jobs declined for both residential and non-residential. This sub-sector comprises establishments whose primary activity is performing specific activities, such as pouring concrete, site preparation, plumbing, painting and electrical work. The construction industry has faced a skilled labor shortage for years. It’s not entirely surprising to see jobs gains in a cooling market, as there are many homes under construction. But the slowdown in homebuilding will put downward pressure on job gains in months to come.”

“Beneath the surface there were some signs in the data that cracks are emerging in the labor market,” said Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C. “Technical factors related to the birth-death model appear to be flattering the headline nonfarm payroll numbers. Employment as measured by the household survey fell by 328,000 in October, and the labor force participation rate once again tumbled back to where it was when the year began.

BLS reported average hourly earnings for all employees on private nonfarm payrolls rose by 12 cents, or 0.4 percent, in October to $32.58. Over the past 12 months, average hourly earnings have increased by 4.7 percent. Average hourly earnings of private-sector production and nonsupervisory employees rose by 9 cents, or 0.3 percent, to $27.86.

The average workweek for all employees on private nonfarm payrolls held at 34.5 hours for the fifth month in a row. In manufacturing, the average workweek for all employees was little changed at 40.4 hours, and overtime decreased by 0.1 hour to 3.1 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls held at 34.0 hours.

“This was the slowest rate of growth since August 2021,” Kan said. “The easing in wage growth might help reduce some inflationary pressure, but we expect the Federal Reserve to continue its current course of policy tightening until there is broader evidence of cooling inflation.”

“The Fed may still be hoping to engineer a ‘soft landing,’ but its top priority is cooling inflation,” Kushi said. “Despite slowdowns in industries such as housing, the Fed will wait for sustained signs of cooling in the labor market – wage growth – before easing the pace of rate hikes.”

“Our sense is that the [Federal Open Market Committee] would prefer to hike by ‘only’ 50 basis points in December, but hot economic data could force the Committee’s hand to once again go 75 bps,” House said. “On net, we doubt [Friday’s] data move the needle much toward a 75 bps hike. A 50 bps rate hike remains our base case, with next Thursday’s Consumer Price Index print the next pivotal piece of data.”