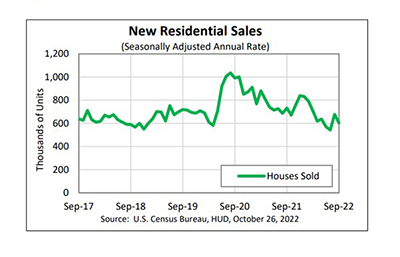

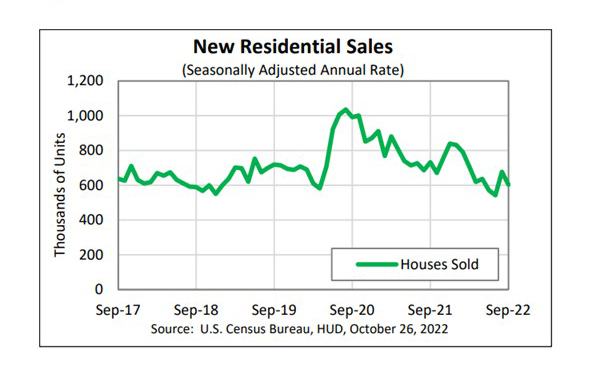

September New Home Sales Down 11%

New home sales fell by nearly 11 percent in September, HUD and the Census Bureau reported Wednesday, as rising interest rates discouraged home buyers.

The report said sales of new single‐family houses in September fell to a seasonally adjusted annual rate of 603,000, 10.9 percent lower than the revised August rate (677,000) and 17.6 percent lower than a year ago (732,000).

Regionally, sales were mixed, with the largest region, the South, dragging down the rest of the country. Sales in the South fell by 20.2 percent in September to 356,000 units, seasonally annually adjusted, from 446,000 units in August and fell by 19.3 percent from a year ago. In the West. sales fell by 0.7 percent to 135,000 units in September from 136,000 units in August and fell by 30.4 percent from a year ago.

In the Midwest, sales rose by 4.3 percent to 73,000 units in September, seasonally annually adjusted, from 70,000 units in August and improved by 10.6 percent from a year ago. In the Northeast, sales jumped by 56 percent to 39,000 units in September from 25,000 units in August and improved by nearly 26 percent from a year ago.

“New home sales are likely to continue to decline in the months ahead,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C. “Mortgage applications for purchase have dropped in every week so far in October and, as of October 21, are down 41.8% over the past year. The weakness in mortgage demand is explained by rising mortgage rates which have moved up markedly and are currently hovering above 7%, much higher than in August and September.”

“Higher mortgage rates continue to weigh on the purchasing power of buyers while also increasing the ‘lock-in’ effect felt by potential move-up buyers,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C. “Homeowners with a mortgage at a lower rate than current rates continue to have a strong incentive to remain in their current homes.”

Duncan noted since the beginning of the pandemic, most homes available for sale were not completed; however, a continual increase in the number of completed homes available for sale is now occurring, with the inventories of such homes now at the highest level since July 2020. “This suggests to us that builders may be increasingly willing to offer more aggressive incentives and discounts to maintain sales of completed inventory,” he said. “If so, this would likely put further downward pressure on home prices.”

The report said the median sales price of new houses sold in September was $470,600; the average sales price was $517,700.

The seasonally adjusted estimate of new houses for sale at the end of September was 462,000, representing a supply of 9.2 months at the current sales rate.