October Construction Spending Down; ISM Index Contracts for 1st Time Since 2020

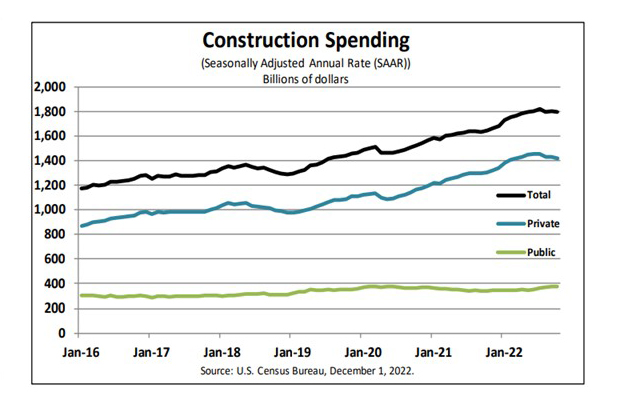

Construction spending dipped in October, the Commerce Department reported Thursday, with slight increase in public construction offset by a decline in private construction.

Separately, the Institute for Supply Management, Phoenix, reported its Manufacturing Report on Business fell for the first time in two and a half years.

The report said overall October construction fell to a seasonally adjusted annual rate of $1,794.9 billion, down by 0.3 percent from the revised September estimate of $1,800.1 billion. However, the October figure is 9.2 percent higher than a year ago ($1,644.3 billion). During the first 10 months of this year, construction spending rose to $1,507.8 billion, 10.8 percent higher than the $1,360.8 billion for the same period in 2021.

Spending on private construction fell to a seasonally adjusted annual rate of $1,420.4 billion, 0.5 percent lower than the revised September estimate of $1,427.6 billion. Residential construction fell to a seasonally adjusted annual rate of $887.2 billion in October, 0.3 percent below the revised September estimate of $890.0 billion. Nonresidential construction was at a seasonally adjusted annual rate of $533.2 billion in October, 0.8 percent below the revised September estimate of $537.6 billion.

Public construction spending rose to an estimated $374.6 billion in October, 0.6 percent above the revised September estimate of $372.5 billion. Educational construction rose to a seasonally adjusted annual rate of $79.4 billion, 0.5 percent above the revised September estimate of $79.0 billion. Highway construction fell to a seasonally adjusted annual rate of $113.4 billion, 0.8 percent below the revised September estimate of $114.3 billion.

“October’s drop in spending occurred mostly with private construction projects,” said Charlie Dougherty, Economist with Wells Fargo Economics, Charlotte, N.C. “The recent weakness in private construction spending is mostly owed to rising interest rates and heightened economic uncertainty. This year’s sharp increase in mortgage rates has resulted in a drop in buyer demand, and builders have responded by curtailing new single-family production. Meanwhile, higher financing costs and uncertainty surrounding the economic outlook appear to be thinning the pipeline of new nonresidential projects and leading banks to tighten lending standards.”

Meanwhile, ISM said economic activity in the manufacturing sector contracted in November for the first time since May 2020 after 29 consecutive months of growth. The Manufacturing ISM Report On Business fell to 49 percent, 1.2 percentage points lower than October.

The New Orders Index remained in contraction territory at 47.2 percent, 2 percentage points lower than the 49.2 percent recorded in October. The Production Index reading of 51.5 percent is a 0.8-percentage point decrease compared to October’s figure of 52.3 percent. The Prices Index registered 43 percent, down 3.6 percentage points compared to the October figure of 46.6 percent; this is the index’s lowest reading since May 2020 (40.8 percent). The Backlog of Orders Index registered 40 percent, 5.3 percentage points lower than the October reading of 45.3 percent. The Employment Index returned to contraction territory (48.4 percent, down 1.6 percentage points) after being unchanged in October at 50 percent. The Supplier Deliveries Index reading of 47.2 percent is 0.4 percentage point higher than the October figure of 46.8 percent.

“The U.S. manufacturing sector dipped into contraction, with the Manufacturing PMI at its lowest level since the coronavirus pandemic recovery began,” said Timothy R. Fiore, Chair of the ISM Manufacturing Business Survey Committee. “With Business Survey Committee panelists reporting softening new order rates over the previous six months, the November composite index reading reflects companies’ preparing for future lower output.

“The decline in November’s ISM manufacturing index to 49.0, the first sub-50 reading since May 2020, reflects the manufacturing sector catching up with orders and supply chain strains easing,” said Sarah House, Senior Economist with Wells Fargo Economics. “However, the better balance has been induced by the painful reason of deteriorating demand. New orders contracted for the fifth time in six months and manufacturers are reducing headcount. The good news is that the weakening growth backdrop is having the Fed’s desired impact on prices; prices paid declined outright for a second straight month.”