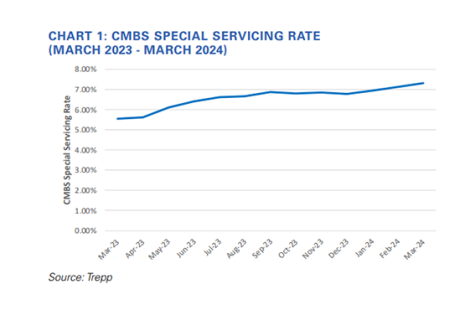

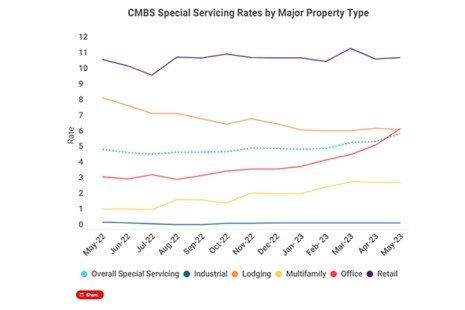

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate jumped 17 basis points in March to 7.31%.

Tag: Trepp

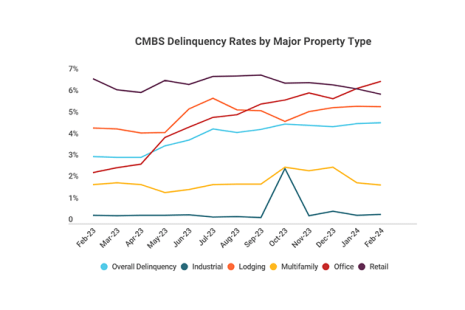

Office Sector Drives CMBS Delinquency Rate Up Slightly: Trepp

The delinquency rate for commercial mortgage-backed securities inched upward in February, according to Trepp, New York.

CMBS Delinquency Rate Ticks Upward: Trepp

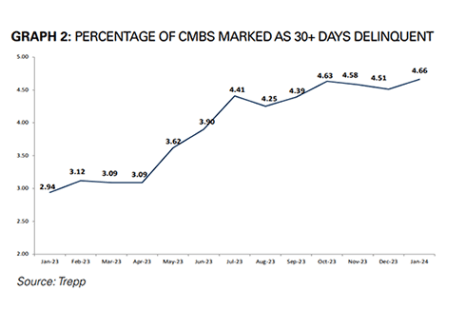

The CMBS delinquency rate rose modestly in January, increasing 15 basis points to 4.66%, according to Trepp, New York.

Trepp: CMBS Delinquency Rate Falls in December

Trepp, New York, noted the overall commercial mortgage-backed securities delinquency rate fell by seven basis points to 4.51% in December.

CMBS Special Servicing Rate Ticks Upward in November: Trepp

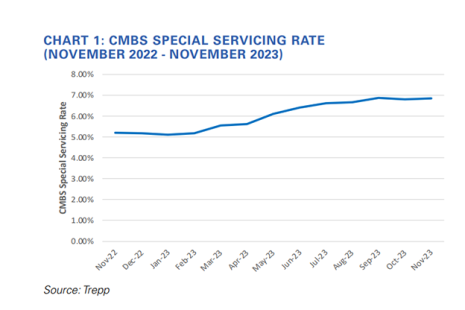

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate increased 4 basis points in November to 6.84%.

Trepp: Special Servicing Rate Climbs in September

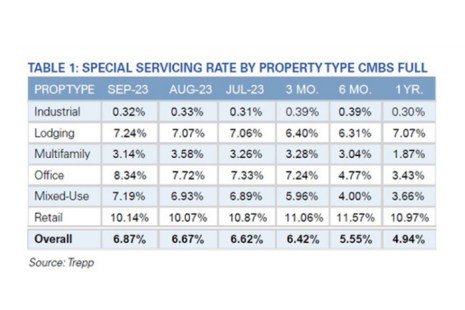

Trepp, New York, reported the CMBS Special Servicing Rate increased by 20 basis points in September, up to 6.87%.

Trepp: Special Servicing Rate Climbs in September

Trepp, New York, reported the CMBS Special Servicing Rate increased by 20 basis points in September, up to 6.87%.

Trepp: Special Servicing Rate Climbs in September

Trepp, New York, reported the CMBS Special Servicing Rate increased by 20 basis points in September, up to 6.87%.

Trepp: CMBS Special Servicing Rate Rises to 6.11%

Trepp, New York, reported its CMBS Special Servicing Rate climbed 49 basis points to 6.11% in May, marking its fourth sequential monthly increase.

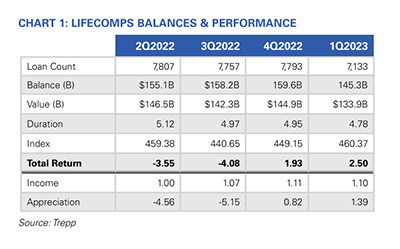

Trepp: Positive Q1 for Insurance Company Commercial Mortgages

Trepp, New York, said its LifeComps index of insurance company commercial mortgage investments saw a 2.5% total return in the first quarter, with 1.4% of that return coming from price appreciation.