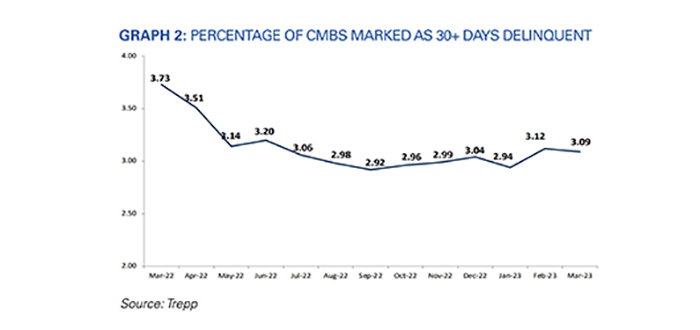

CMBS Delinquency Rate Dips; Offices See Increase

The commercial mortgage-backed securities delinquency rate fell slightly in March, but the segment that everyone watches closely–office–saw its rate move higher again, reported Trepp, New York.

Trepp said the overall CMBS delinquency rate fell three basis points during the month to 3.09%. “A big decline in the retail rate, along with small improvements in industrial and hotel, helped the overall number,” Trepp said in its March CMBS Delinquency report. “However, the office market–for which sentiment has turned sharply negative over the last few months–saw a sizable uptick last month. Concerns over the office segment were already high before 2023 over higher interest rates, looming maturity, falling values and uncertainty about demand post-COVID.”

Trepp said the office sector’s tone has grown decidedly worse over the past three months as some large office loans held by big property owners have defaulted or been sent to special servicing. “In addition, a tightening of credit conditions in CMBS and with bank lending has made capital even more scarce,” the report said.

Trepp noted the record CMBS delinquency rate high was 10.34% in July 2012. The COVID-19 high reached 10.32% in June 2020.

The overall U.S. CMBS delinquency rate is down 64 basis points compared to a year ago, but the rate is up five basis points year to date, Trepp said. The percentage of loans seriously delinquent (60-plus days delinquent, in foreclosure, REO or non-performing balloons) now equals 2.85%.

In a separate report, Fitch Ratings, New York, said it expects a degree of permanent valuation impairment for weaker office assets as the market reprices the office sector, similar to Class-B malls, with slower cash flow growth and higher obsolescence risk.

“Lower office space demand stemming from accelerated flexible work arrangements in the pandemic bears some likeness to a secular decline in physical space requirements for lower quality retail formats (such as Class B malls) occurring due to rapid e-commerce growth,” Fitch said in its U.S. Office CRE Capital Access Weakening report.

Fitch noted the decline in office space demand will likely be sustained for the foreseeable future, similar to Class B malls and with similar implications for limited new supply but negative implications for valuations for weaker properties exposed to obsolescence risk.

Fitch said it expects office loan delinquency rates for U.S. CMBS to increase from 1.45% on March 31 to 3.5% to 4.0% by year-end.

“Weak market sentiment will make it difficult for many office loans to refinance at maturity,” the report said, noting the pandemic accelerated and expanded a shift to lower tenant space demand. “This will pressure occupancies, cash flow and reduce financing availability from banks, non-bank financial institutions, CMBS and other mortgage lenders. It said U.S. office real estate investment trusts will likely have similar challenges in accessing senior unsecured debt.