Trepp: Bank Loans Outperforming CMBS Loans

Trepp, New York, said the bank-issued commercial real estate loans it tracks generally performed better than commercial mortgage-backed securities loans last year.

“This comes as no surprise, but similar trends across property types can still be seen when comparing,” said Jack LaForge, Research Analyst with Trepp.

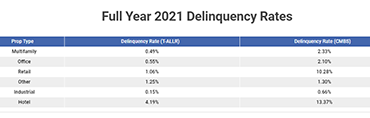

In a report, Trepp said the delinquency rate for the bank-issued commercial real estate loans it tracks peaked at 1.3 percent in fourth-quarter 2020 while the delinquency rate for CMBS loans peaked at 10.32 percent in July 2020. It noted the overall commercial real estate delinquency rate stood at 0.9 percent in late 2021, while the more serious delinquencies rate stood at 0.7 percent, both still above their pre-pandemic levels.

The report said the retail and lodging sectors had the largest concentrations of delinquent loans for both lending sources. “These were the two sectors within commercial real estate that were hardest hit by the pandemic,” LaForge noted. In both bank lending and CMBS lending, the multifamily sector experienced the most loan originations out of any sector, the report noted. CMBS loan originations totaled $54.8 billion last year while Trepp’s bank loan origination data amounted to $15.8 billion.

“In 2021, the multifamily sector remained one of the safer property types to invest in given low delinquency and default rates, and is thus a popular investment vehicle for both CMBS and bank commercial real estate lenders,” LaForge said.