Trepp: Positive Q1 for Insurance Company Commercial Mortgages

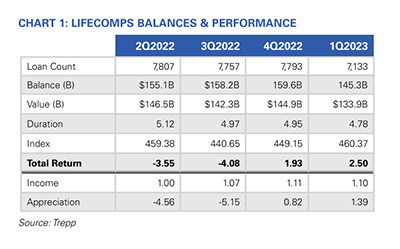

Trepp, New York, said its LifeComps index of insurance company commercial mortgage investments saw a 2.5% total return in the first quarter, with 1.4% of that return coming from price appreciation.

This positive news follows a spring report that the index saw a -10.1% return in full-year 2022.

The LifeComps report noted, however, that the office sector’s current status–with some notable defaults and big city office building utilization rates around 50%, among other factors–may point to future issues.

In the primary market, the LifeComps portfolio reported 91 new loans funded in the first quarter. That compares with 116 quarter-over-quarter; the report pegs the decline on the high interest rate environment.

“It’s worth noting that with news of a banking crisis in March and a potential credit crunch in the banking industry, life insurers may step in the vacuum and provide credit to the borrowers,” the report said. “During the last crisis in 2009, life insurers kept a stable exposure to the mortgage market, so Trepp will keep an eye on the origination market development this time around too.”