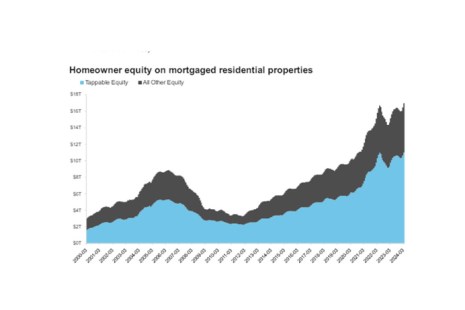

Intercontinental Exchange Inc., Atlanta, reported that mortgage holders at the end of the third quarter held $17.2 trillion in equity.

Tag: Tappable Equity

ICE Mortgage Monitor: Q1 Sees Record Levels of Tappable Equity

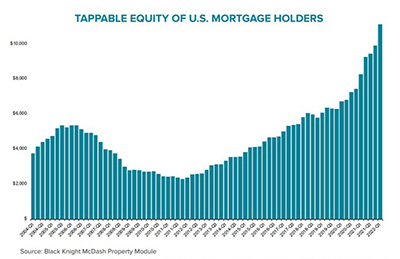

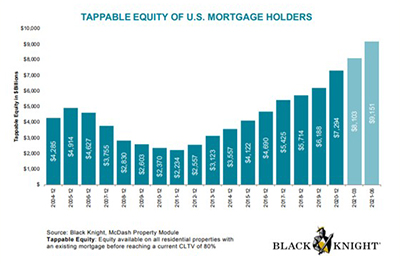

Intercontinental Exchange Inc., Atlanta, released its ICE Mortgage Monitor report for May, finding that homeowners with mortgages closed out the first quarter with a record $16.9 trillion in equity–$11 trillion of which was tappable.

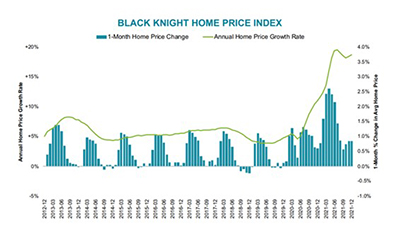

Black Knight: Tappable Equity Likely Peaked in Spring

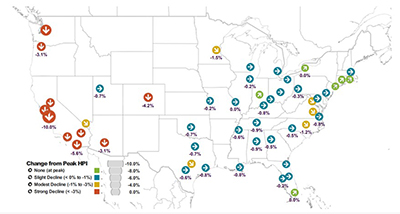

Black Knight, Jacksonville, Fla., said falling home prices likely resulted in homeowners’ tappable equity peaking this past May.

Mortgage Holders Gain $1.2 Trillion in 1Q Tappable Equity

The least-affordable housing market in nearly two decades provides at least one windfall—the average home has gained nearly 9 percent in value since just the start of 2022, with homeowners gaining more than $1.2 trillion in equity in the first quarter, said Black Knight, Jacksonville, Fla.

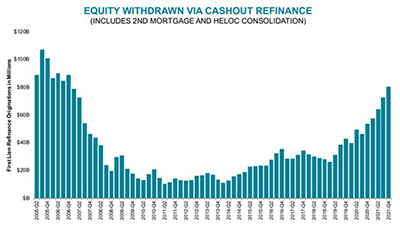

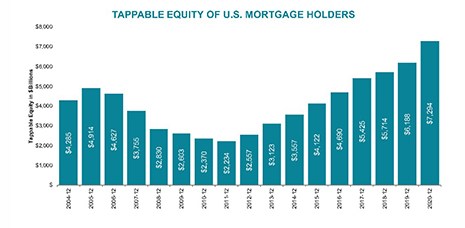

Black Knight: Homeowners Tap Equity at 16-Year High

Black Knight, Jacksonville, Fla., said lenders originated a record 4.4 trillion in 2021, including a record $1.7 trillion in purchase loans.

Home Prices Re-accelerate; Equity Smashes Records; ‘Worst Affordability in 14 Years’

Black Knight, Jacksonville, Fla., said inventory shortfalls caused home prices to re-accelerate in 2021, putting pressure on home affordability but also creating for homeowners a record amount of tappable equity.

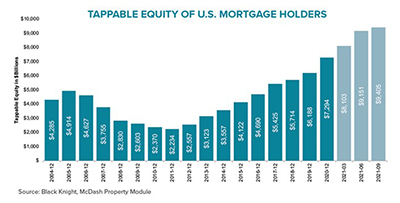

Black Knight: Tappable Equity Surges to Record-High $9.4 Trillion

Black Knight, Jacksonville, Fla., said tappable equity – the amount available for homeowners to access while retaining at least 20% equity in their homes – rose by 32% over the past year, an increase of $2.3 trillion over the past year.

Black Knight: Tappable Equity Rises to Record-High $9.1 Trillion

Driven by the red-hot housing market, tappable equity – the amount available to homeowners before reaching a maximum 80% combined loan-to-value ratio – surged nearly 40% from last year to a record $9.1 trillion in the second quarter, said Black Knight, Jacksonville, Fla.

Black Knight: Tappable Equity Skyrockets to Record High

A rising tide lifts all boats, the saying goes. And for the nation’s homeowners, home price growth—buoyed by scant housing inventories and historically low interest rates—created unprecedented tappable equity in 2020, said Black Knight, Jacksonville, Fla.

Black Knight: Cash-Out Refinances Fall Despite Record-High Tappable Equity

Black Knight, Jacksonville, Fla., said homeowners’ tappable equity rose by 8% annually in the first quarter to a record-high $6.5 trillion.