Black Knight: Cash-Out Refinances Fall Despite Record-High Tappable Equity

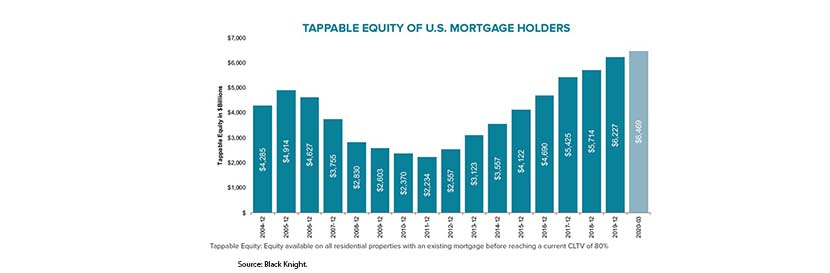

Black Knight, Jacksonville, Fla., said homeowners’ tappable equity rose by 8% annually in the first quarter to a record-high $6.5 trillion.

Black Knight said with mortgage interest rates hitting record lows in recent weeks, 90% of homeowners with tappable equity now have first lien rates above the prevailing market average; more than 75% have rates above 3.5%

The report said the first quarter also saw overall refinance originations climb to a seven-year high, but at the same time, the number of cash-out refinances – as well as the volume of equity withdrawn via refinance – fell for the first time since early 2019. While rate/term refinances rose by 18% from the fourth quarter, cash-out lending fell by 7% over the same period, despite record-low 30-year rates and record-high tappable equity

Black Knight Data & Analytics President Ben Graboske said that trend may well continue, as the cash-out share of refinance activity has continued to fall throughout the second quarter.

“Through June 19, cash-out refinance locks were down 6% from the comparable time frame in Q1 2020, while rate/term locks were up 13% – even including the massive wave of refinance locks seen in early March,” Graboske said. “The environment is ripe for that surge of rate/term refinance lending to continue as well. Despite rising delinquencies cutting into the number of homeowners who would otherwise meet broad-based eligibility requirements to refinance, some 13.6 million homeowners still meet those criteria, which include being current on their mortgage, and could shave at least 0.75% off their first lien rates by refinancing.”

Graboske notd all in, cash-outs accounted for just 42% of refinance loans in the first quarter, roughly half of what was seen at the recent high in Q4 2018 and the lowest such share since Q1 2016. “Rate lock data – a good indicator of lending activity – suggests the trend is likely to continue, as the cash-out share of refinance activity has continued to fall throughout the second quarter,” he said.

If all eligible candidates were to refinance their mortgages, they would see an aggregate savings of $3.9 billion per month, “representing a potentially significant and much-needed stimulus to the economy,” Graboske said. Of these, some 4.6 million could save at least $300 per month on their mortgage payments, while 2.6 million would be able to save at least $400 per month.