Home Prices Re-accelerate; Equity Smashes Records; ‘Worst Affordability in 14 Years’

Black Knight, Jacksonville, Fla., said inventory shortfalls caused home prices to re-accelerate in 2021, putting pressure on home affordability but also creating for homeowners a record amount of tappable equity.

A separate report from the American Enterprise Institute, Washington, D.C., showed the tight, competitive housing market continued to drive up prices across the top 60 metro markets.

The monthly Mortgage Monitor Report said tappable equity – the amount available for mortgage holders to access while retaining at least 20% equity in their homes – increased by 35% in 2021, for an aggregate total of nearly $10 trillion. The $2.6 trillion gain was the largest annual increase on record – more than double 2020’s prior high of $1.1 trillion – giving the average homeowner a $48,000 bump for a total of $185,000 in available equity.

The report also noted rising equity stakes pushed the total market combined loan-to-value ratio below 45% for the first time on record – down from 50% at the end of 2020.

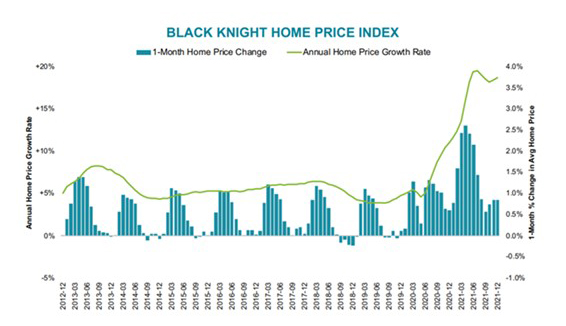

Home prices, however, began to re-accelerate, the report said. While the rate of home price growth had been slowing since mid-summer, the trend reversed course in recent months, with severe supply shortages putting continued upward pressure on prices. After beginning to improve in the fall, inventory shortfalls began to intensify again in the final months of 2021, with the market currently facing a deficit of as many as 750,000 “missing” for-sale listings

The report said with prices still climbing alongside rising interest rates, the monthly principal and interest payment required to buy the average-priced home with 20% down has risen by 32% since the same time last year. The mortgage payment on the average home purchase takes 25.8% of the median household income, surpassing the long-term, pre-Great Recession average (25%) to mark the worst affordability since 2008.

“At a time of the year that typically sees little to no price movement, home prices increased by 0.84% last month, marking the largest December price growth on record,” said Black Knight Data & Analytics President Ben Graboske. “Home price appreciation over the course of 2021 was unlike anything that’s come before, and the incredible growth we’ve seen in homeowner equity is testament to that fact.”

Graboske said data suggest the trend continued in January, even as interest rates began to spike. “The interplay between prices and rates has significantly impacted affordability and borrower buying power in recent weeks,” he said. “Homebuyers are increasingly choosing to pay more in points to buy down the rates on their mortgages to partially offset the effect of recent rate increases, further increasing the burden on today’s homebuyers.”

Meanwhile, AEI reported the tight, competitive housing market continued to drive up prices across the top 60 metro markets. The AEI National and Metro Housing Market Indicators showed home prices are “booming” everywhere, with Phoenix, North Port, Fla., Cape Coral, Fla., Austin and Raleigh leading the way.

The report said every major Florida metro area experienced above-average home price appreciation in the third quarter, ranging from 19.1% in Miami to 28.8% in North Port. AEI said even relatively inexpensive metros in the Southeast and the West have picked up Work from Home buyers taking advantage of price disparities between different metros, increasing their housing standards while reducing their costs.

The report said lower-priced areas attracting homebuyers from more expensive metros generally have a high share of new construction sales, yet months’ supply remains depleted. More than 20% of home sales in Austin, San Antonio, Dallas, Houston, and Boise, Idaho, are new construction.