Mortgage Holders Gain $1.2 Trillion in 1Q Tappable Equity

The least-affordable housing market in nearly two decades provides at least one windfall—the average home has gained nearly 9 percent in value since just the start of 2022, with homeowners gaining more than $1.2 trillion in equity in the first quarter, said Black Knight, Jacksonville, Fla.

The company’s Mortgage Monitor Report noted though the annual rate of appreciation cooled slightly (19.9% in April vs. an upwardly revised 20.4% for March), rising home prices and interest rates have made for the worst affordability since July 2006. The monthly principal and interest payment on the average-priced home with 20% down is nearly $600 (+44%) more than it was at the start of the year and $865 (+79%) more than before the pandemic. As of May 19, with 30-year mortgage rates at 5.25%, the share of median income required to make that P&I payment had climbed to 33.7%, just shy of the 34.1% high reached in July 2006.

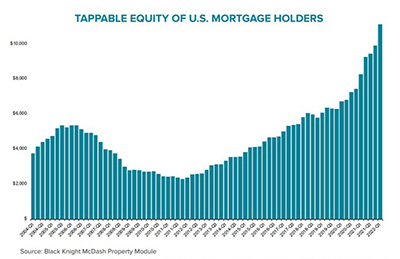

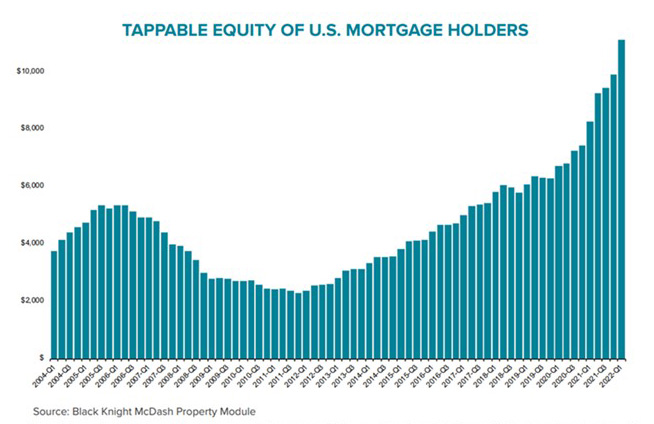

However, mortgage holders saw their collective tappable equity – the amount available to borrow against while retaining at least a 20% equity stake in the home – increase by $1.2 trillion in Q1 2022 alone. In total, mortgage holders gained $2.8 trillion in tappable equity over the past 12 months – a 34% increase that equates to more than $207,000 in equity available per borrower.

“In total, American mortgage holders have more than $11 trillion in tappable equity, also a history-making total,” said Black Knight Data & Analytics President Ben Graboske. “It really is a bifurcated landscape – one that grows ever more challenging for those looking to purchase a home but is simultaneously a boon for those who already own and have seen their housing wealth rise substantially over the last couple of years. Depending upon where you stand, this could be the best or worst of all possible markets.”

The report also noted despite a rise of 27,500 from March to April, active listings remain 67% below pre-pandemic levels, with 820,000 fewer listings than would be typical at this point in most homebuying seasons. New listing volumes were up 1% from the same time last year but remained 11% below pre-pandemic levels for the month of April, suggesting that the number of homes hitting the market remains well below what would be considered “normal” levels.