Optimal Blue’s AI assistants tackle real-world challenges lenders face by combining value-driven innovation with mortgage expertise.

Tag: Optimal Blue

Optimal Blue: Revolutionizing Capital Markets with AI [Sponsored]

Optimal Blue’s AI assistants tackle real-world challenges lenders face by combining value-driven innovation with mortgage expertise.

(Sponsored) Optimal Blue: Revolutionizing Capital Markets with AI

Optimal Blue’s AI assistants tackle real-world challenges lenders face by combining value-driven innovation with mortgage expertise.

Optimal Blue: Revolutionizing Capital Markets with AI (Sponsored Content)

Optimal Blue’s AI assistants tackle real-world challenges lenders face by combining value-driven innovation with mortgage expertise.

Optimal Blue: Rate Lock Volume Up 3.5% in July

Optimal Blue, Plano, Texas, released its Optimal Blue Market Advantage report for July, finding that the overall rate lock volume was up 3.5% month-over-month.

Industry Briefs, Aug. 6, 2024

News in brief from Optimal Blue, Candor Technology, CMG Mortgage, Williston Financial Group, Informative Research, Cornerstone Servicing, Atlantic Coast Mortgage and CRMNow.

People in the News, June 18, 2024

Industry personnel news from Optimal Blue, Dovenmuehle, ServiceLink and Incenter Lender Services.

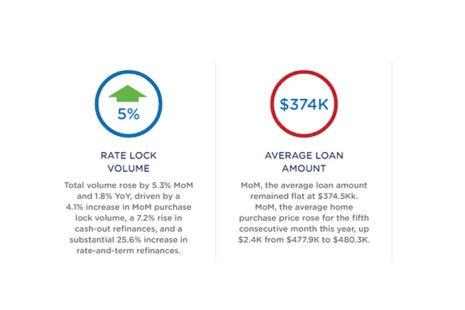

Optimal Blue: Rate-and-Term Refis Jump in May

Optimal Blue, Plano, Texas, released its Market Advantage Mortgage Data Report for May, finding, among other metrics, an almost 26% increase in rate-and-term refinances in May.

Optimal Blue Sponsored Content–Three Necessities in a Capital Markets Platform

Master your margins with comprehensive capital markets technology

Three Necessities in a Capital Markets Platform–Optimal Blue Sponsored Content

Master your margins with comprehensive capital markets technology