Optimal Blue: Homebuyer Credit Score Reaches High of 737

(Image courtesy of Optimal Blue)

Optimal Blue, Plano, Texas, released its March 2024 Originations Market Monitor report, finding that the average homebuyer credit score–at 737–is the highest since the firm began tracking the data in 2018.

“Driven by rising interest rates and home prices, we’re witnessing the highest average homebuyer credit scores in years,” said Brennan O’Connell, Director of Data Solutions at Optimal Blue. “This unprecedented level of creditworthiness among purchasers is largely a result of the affordability issues borrowers face in today’s housing market, with prospective buyers with lower credit scores waiting on the sidelines until conditions improve. However, it is encouraging to see a strong pool of qualified buyers still actively pursuing homeownership. This trend underscores the resilience of the market and the adaptability of consumers in navigating the current economic landscape.”

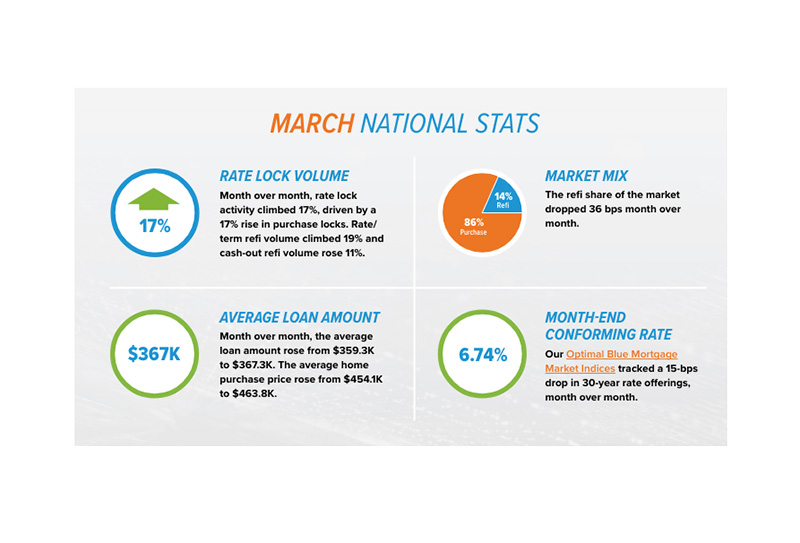

Rate lock volume grew by 17% in March as the spring buying season kicked off, with a 17% rise in purchase locks. Refinances remained a small share of lock volume, but rate/term activity was up 19% and cash-out activity was up by 11%. Overall, the refi share of the market dropped by 36 basis points.

However, March purchase lock counts were down 24% year-over-year. But, Optimal Blue notes an early Easter weekend may have stymied some homebuyer activity, and April and May figures will be a better test of the market’s health.

The average loan amount was up by $8,000 to $367,300, and the average home purchase price grew by $9,700 to $463,800.

In terms of market share, Federal Housing Administration loans declined by 0.72% to end at 19% of total lock volume. That’s down from a peak of 23% in November 2023.

Conforming loans had 57.6% of market volume, nonconforming at 11.8%, Veterans Affairs loans at 10.9%, and U.S. Department of Agriculture loans at 0.6%.