Optimal Blue: Lock Volume Rises 36% Month-Over-Month in January

(Illustration courtesy of Optimal Blue)

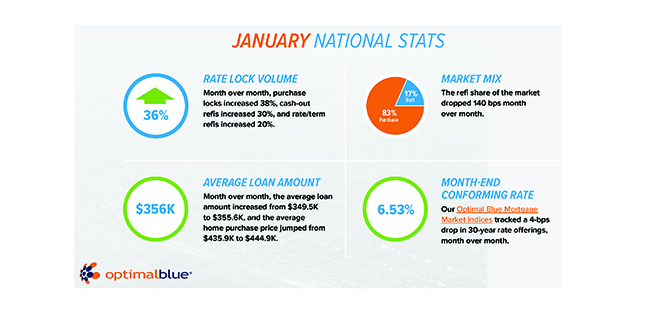

Optimal Blue, Plano, Texas, said mortgage lock volume rose 36% month-over-month in January as rates eased.

“The new year kicked off with continued rate relief and a 36% month-over-month gain in total lock volume, driven by a seasonal 38% increase in purchase lock volume,” said Brennan O’Connell, Optimal Blue’s director of data solutions. “We also saw the smallest year-over-year decline in purchase lock counts since May 2022, which may foreshadow a stabilizing market and friendlier lending environment in 2024.”

In addition to the month-over-month climb in purchase lock volume, the firm’s Jan. 2024 Originations Market Monitor report said cash-out and rate/term refinance volumes rose 30% and 20%, respectively. The Optimal Blue Mortgage Market Indices 30-year conforming rate dropped 4 basis points in January to finish the month at 6.53% after a mid-month peak at 6.7%. FHA and VA rates also fell in January, dropping 4 basis points and 3 basis points, respectively, while jumbo rates moved in the other direction with an 11-bps increase since year-end.

Mortgage rates fell despite a month-over-month 15 basis point increase in the 10-year Treasury yield in January, leading to a 19 basis point narrowing of the mortgage-to-Treasury spread. At approximately 250 basis points, the January spread reached levels not seen since mid-2022. While still elevated relative to historical averages, the spread has narrowed significantly since eclipsing 300 basis points on multiple occasions in 2023.

Conforming products gained market share to start the year, rising 72 basis points to account for 57.3% of total volume. Non-conforming products including jumbo and non-QM loans rose 27 basis points to make up 9.7% of total volume. Ginnie Mae-eligible products moved inversely, however, with the FHA share dropping 87 basis points and the VA share falling 13 basis points, each representing 20.7% and 11.7% of total volume, respectively.

The share of adjustable-rate mortgage products stayed consistent at just above 5% of total volume. Improving rate conditions and an inverted yield curve have limited the demand for ARM loans. The rise in lock volume coincided with a January climb in average credit scores across all products and loan purposes. The average loan amount also rose, increasing from $349.5K to $355.6K. Finally, after six consecutive months of decline, the average home purchase price rebounded, jumping from $435,900 to $444,900.