The emergence of intelligent automation, which is the use of automation technologies–artificial intelligence, business process management and robotic process automation–is transforming how mortgage servicers do business.

Tag: Mortgage Servicing

Clarifire’s Jane Mason: To Survive, the Fittest Organizations Need AI—But That’s Not All

AI holds the potential to unleash productivity throughout the mortgage lifecycle by bringing the origination and servicing sides of the business together.

Clarifire’s Jane Mason: To Survive, the Fittest Organizations Need AI—But That’s Not All

AI holds the potential to unleash productivity throughout the mortgage lifecycle by bringing the origination and servicing sides of the business together.

Clarifire’s Jane Mason: To Survive, the Fittest Organizations Need AI—But That’s Not All

AI holds the potential to unleash productivity throughout the mortgage lifecycle by bringing the origination and servicing sides of the business together.

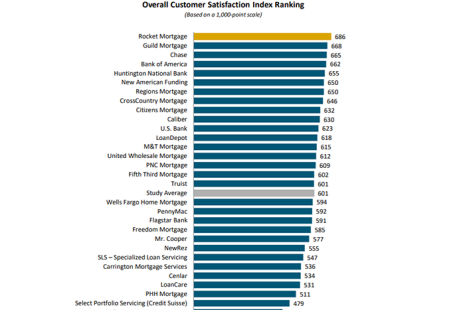

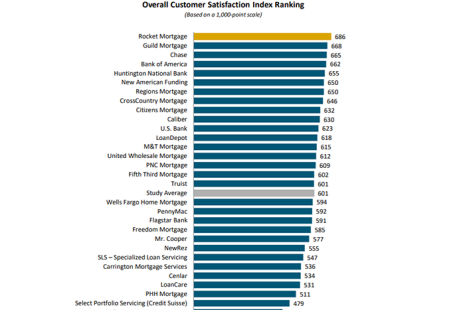

Uncertainty, Financial Challenges Driving Down Satisfaction with Mortgage Servicers

With mortgage rates at their highest level since November 2022 and costs for everything from home insurance to maintenance still elevated, mortgage servicer customers are feeling strained, reported J.D. Power, Troy, Mich.

Uncertainty, Financial Challenges Driving Down Satisfaction with Mortgage Servicers

With mortgage rates at their highest level since November 2022 and costs for everything from home insurance to maintenance still elevated, mortgage servicer customers are feeling strained, reported J.D. Power, Troy, Mich.

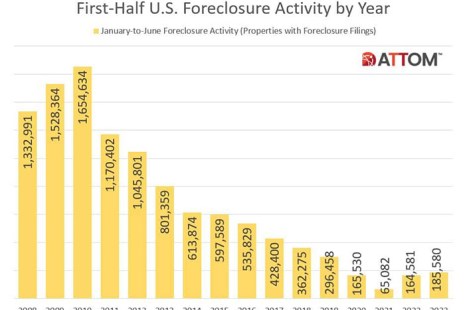

Foreclosure Activity Ticks Upward

ATTOM, Irvine, Calif., found a total of 185,580 U.S. properties with foreclosure filings–default notices, scheduled auctions or bank repossessions–between January and June, up 13% from a year ago.

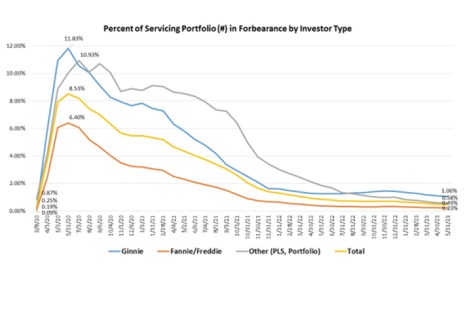

MBA: Share of Mortgage Loans in Forbearance Drops to 0.49% in May

The total number of loans now in forbearance decreased to 0.49% for May from 0.51% of servicers’ portfolio volume in April, the Mortgage Bankers Association’s monthly Loan Monitoring Survey reported.

MBA Comments on HUD COVID-Related Loss Mitigation Report

The HUD Office of the Inspector General issued two audit reports Thursday examining the loss mitigation options that loan servicers provided to borrowers with FHA-insured loans after their COVID-19 forbearance ended.

Fitch: RMBS Servicers Focus on Struggling Borrowers; Delinquencies Remain Flat

Servicers continued to work with struggling homeowners to avoid loan default as delinquent loans remained flat in late 2022, according to Fitch Ratings’ fourth-quarter U.S. RMBS Servicer Metric Report.