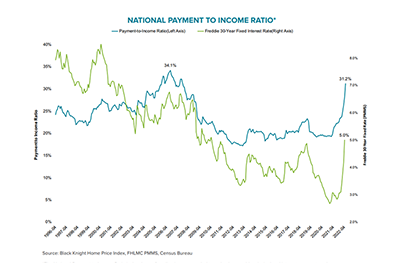

Though home price appreciation slowed slightly in March, 30-year mortgage interest rates above 5 percent have pushed affordability to nearly its worst-ever level, said Black Knight, Jacksonville, Fla.

Tag: Mortgage Monitor

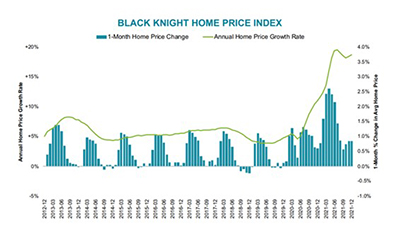

Black Knight: Annual Price Growth at Record High

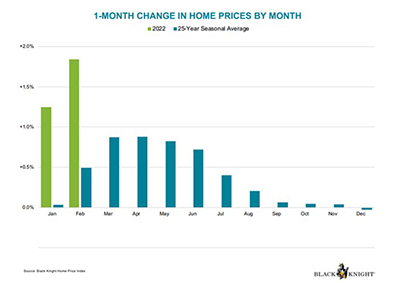

Black Knight, Jacksonville, Fla., said home prices rose by 1.84% in February – nearly four times the 25-year average for the month – marking the 14th month of the pandemic to see greater than 1% monthly growth.

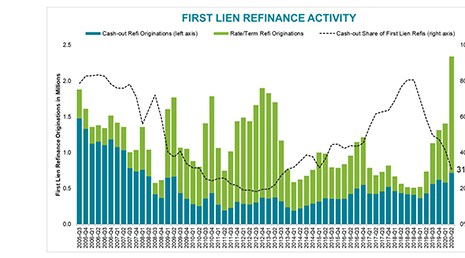

Black Knight: Homeowners Tap Equity at 16-Year High

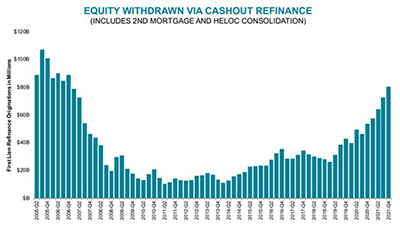

Black Knight, Jacksonville, Fla., said lenders originated a record 4.4 trillion in 2021, including a record $1.7 trillion in purchase loans.

Home Prices Re-accelerate; Equity Smashes Records; ‘Worst Affordability in 14 Years’

Black Knight, Jacksonville, Fla., said inventory shortfalls caused home prices to re-accelerate in 2021, putting pressure on home affordability but also creating for homeowners a record amount of tappable equity.

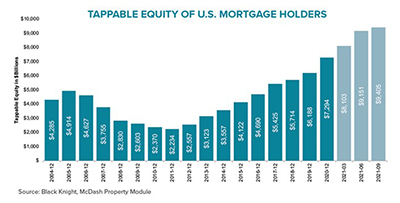

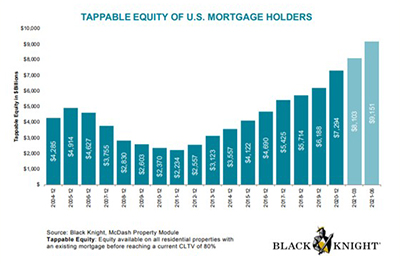

Black Knight: Tappable Equity Surges to Record-High $9.4 Trillion

Black Knight, Jacksonville, Fla., said tappable equity – the amount available for homeowners to access while retaining at least 20% equity in their homes – rose by 32% over the past year, an increase of $2.3 trillion over the past year.

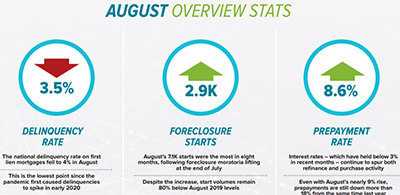

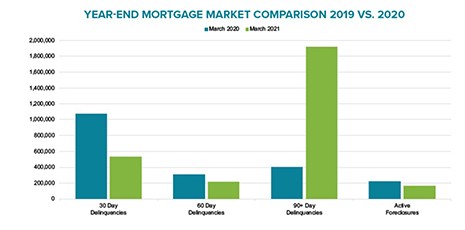

Black Knight: Strong Equity Could Affect Foreclosure Starts

Black Knight, Jacksonville, Fla., said even though just 7% of homeowners in forbearance have less than 10% equity after including 18 months of deferred payments, the potential for foreclosure activity persists.

Black Knight: Tappable Equity Rises to Record-High $9.1 Trillion

Driven by the red-hot housing market, tappable equity – the amount available to homeowners before reaching a maximum 80% combined loan-to-value ratio – surged nearly 40% from last year to a record $9.1 trillion in the second quarter, said Black Knight, Jacksonville, Fla.

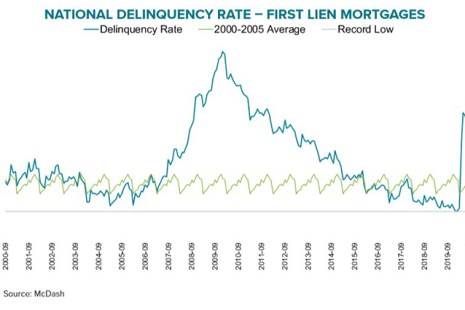

Black Knight: Delinquencies at Record Low: MBA to Release National Delinquency Survey Friday

Ahead of this Friday’s release of the Mortgage Bankers Association’s 1st Quarter National Delinquency Survey, Black Knight, Jacksonville, Fla., said just 217,000 homeowners became past due on their mortgages in March, the lowest such delinquency inflow of any month on record.

Black Knight: Rate Lock Data Suggests 2020 Originations Could Surpass $4 Trillion

Black Knight, Jacksonville, Fla., said its monthly Mortgage Monitor report shows rate lock activity continues to remain strong across the board, which could lead to new quarterly and yearly records for origination volume.

Black Knight: Refi Surge Spurs Record Quarterly Origination Volume

Black Knight, Jacksonville, said record-low mortgage rates triggered a surge in refinancing in the second quarter, leading to the largest quarterly origination volume dating back to 2000.