Black Knight: Refi Surge Spurs Record Quarterly Origination Volume

Black Knight, Jacksonville, said record-low mortgage rates triggered a surge in refinancing in the second quarter, leading to the largest quarterly origination volume dating back to 2000.

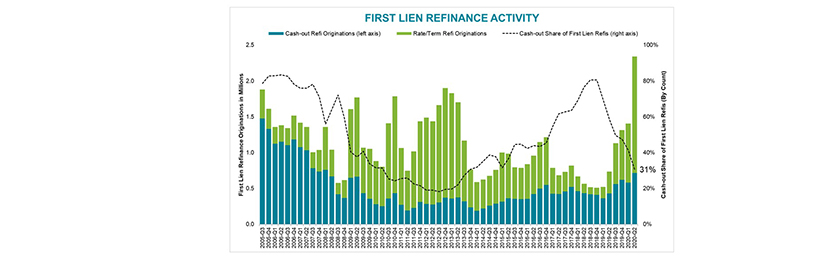

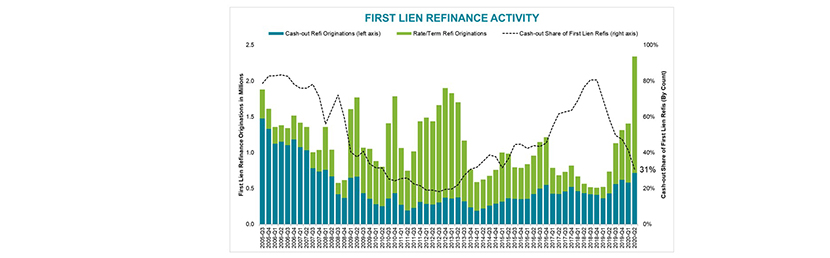

The company’s monthly Mortgage Monitor said the second quarter saw the largest quarterly origination volume on record, with nearly $1.1 trillion in first lien mortgages originated. Refinance lending led the way, with volume up by more than 60% from the first quarter and more than double from a year ago, accounting for nearly 70% of all first lien originations by dollar value.

“Despite the nation being under pandemic-related lockdowns for much of the quarter, a record-breaking surge in mortgage originations occurred in Q2 2020, driven by the record-low interest rate environment,” said Ben Graboske, Black Knight President of Data and Analytics.

Graboske said rate lock data – a leading indicator of lending activity – supports the growing consensus that the spring homebuying season was shifted forward into the summer months by the COVID-19 pandemic. The report said overall, purchase locks scheduled to close in the third quarter are now 23% above the seasonal expectation, more than making up for Q2’s COVID-19-related shortfall, with Q2 and Q3 combined more than 6% above their expected seasonal volumes based on January’s pre-pandemic baseline

Additionally, the report said locks on refinance loans that are expected to close in the third quarter (assuming a 45-day lock-to-close timeline) are up 20% from Q2, suggesting Q3 refi volumes could be even higher than the record-setting Q2 volume

The report said despite a nearly 17-year high for refinance originations, just 22% of rate/term refinance and 13% of cash-out refinance borrowers were retained in servicers’ portfolios

“With market conditions as they are and given the recent delay of the 50 basis points fee on GSE refinances until December, we would expect near-record low interest rates to continue to buoy the market,” Graboske said. “After all, there are still nearly 18 million homeowners with good credit and at least 20% equity who stand to cut at least 0.75% off their current first lien rate by refinancing.”

The report noted in the midst of record-breaking refinance volume, retention woes persist for mortgage servicers, with the report showing just 18% of all refinancing borrowers being retained post-refinance in the second quarter. Despite a nearly 17-year high in refinance originations, the business of just 22% of rate/term borrowers and a mere 13% of cash-out refinance borrowers was retained in servicers’ portfolios post-transaction. Graboske said while that is a marked improvement for rate/term refinance retention rates since last quarter, it still results in servicers losing nearly 80% of their refinancing customers.

The report further notes that, though rate/term refinance borrowers are indeed price-sensitive, high-credit borrowers refinancing into GSE mortgages in Q2 received an interest rate only 7 basis points lower on average than borrowers who were retained. While pricing is certainly important, the marginal rate differences between retained and lost borrowers suggest that proactively identifying and marketing to high-risk prepay cohorts may likely be key to raising retention rates.