First-time homebuyers accounted for a record share of agency purchase lending in the first quarter as higher interest rates continue to dampen repeat buyer participation in the market, according to Intercontinental Exchange Inc.

Tag: Mortgage Monitor

ICE: Home Prices Cool Heading into Spring Home-Buying Season

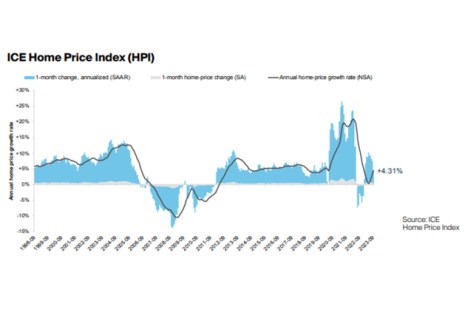

Intercontinental Exchange found a “notable cooling” in home price growth as the 2025 spring home buying season begins.

ICE: 2024 Saw Softest Home Price Growth in Years; Mortgage Delinquencies Trending Higher

Home prices ended the year on an up note, but 2024 was the softest year for home price growth in more than a decade, according to Intercontinental Exchange.

ICE: September, October See Refinance Surge

Intercontinental Exchange Inc., Atlanta, released its Mortgage Monitor, finding that more than 300,000 refinances closed in September and October–the most in 2.5 years.

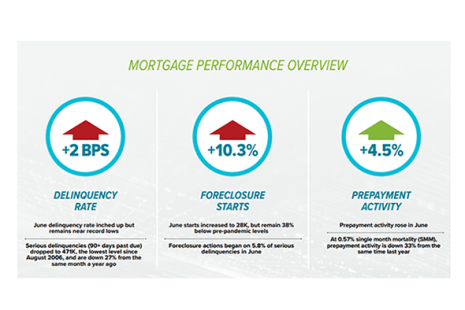

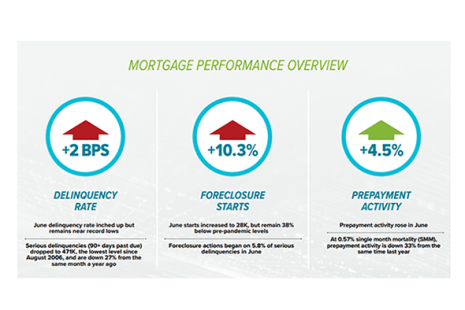

ICE Mortgage Monitor: Affordability Continues to Weigh on Market

Intercontinental Exchange, Atlanta, released the November 2023 Mortgage Monitor Report, highlighting that high interest rates continue to drag down affordability and dampen demand.

Black Knight: Housing Market Reheating

The housing market is “reheating,” with home prices hitting new peaks at the national and local level and no end in sight to the inventory shortage driving price increases, reported Black Knight, Jacksonville, Fla.

Black Knight: Housing Market Reheating

The housing market is “reheating,” with home prices hitting new peaks at the national and local level and no end in sight to the inventory shortage driving price increases, reported Black Knight, Jacksonville, Fla.

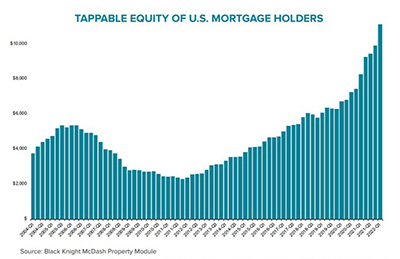

Black Knight: Tappable Equity Likely Peaked in Spring

Black Knight, Jacksonville, Fla., said falling home prices likely resulted in homeowners’ tappable equity peaking this past May.

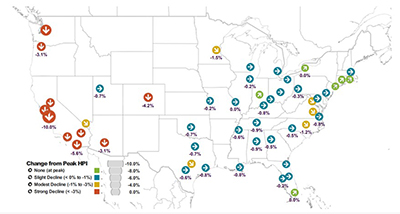

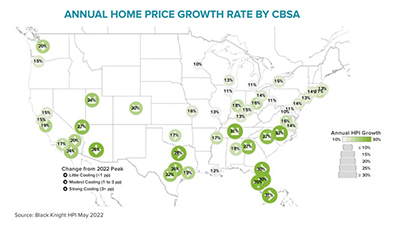

Black Knight: Signs of Home Price Cooling as Inventory Levels Improve

Black Knight, Jacksonville, Fla., said home price growth slowed in 97 of the 100 largest U.S. housing markets in May, with the national annual appreciation rate pulling back by more than a full percentage point from April.

Mortgage Holders Gain $1.2 Trillion in 1Q Tappable Equity

The least-affordable housing market in nearly two decades provides at least one windfall—the average home has gained nearly 9 percent in value since just the start of 2022, with homeowners gaining more than $1.2 trillion in equity in the first quarter, said Black Knight, Jacksonville, Fla.