Black Knight: Housing Market Reheating

(Courtesy Black Knight)

The housing market is “reheating,” with home prices hitting new peaks at the national and local level and no end in sight to the inventory shortage driving price increases, reported Black Knight, Jacksonville, Fla.

“We’ve been noting for some months that the recent rate of home price gains would have a lagging, but significant, impact on the annual rate of appreciation,” said Black Knight Vice President of Enterprise Research Andy Walden. “Well, June marked that inflection point. Not only has the Black Knight Home Price Index reached a new record high – on both seasonally adjusted and non-adjusted bases – but 60% of major markets have done so as well.”

Black Knight released its Mortgage Monitor report Monday.

Walden noted the annual growth rate jumped back to 0.8% in June after slowing for 14 straight months amid widespread growth that saw annual rates of appreciation inflect and begin to trend higher in more than 80% of markets. “Rising home prices have boosted homeowner equity levels as well, which had been retreating from their 2022 highs not very long ago,” he said. “In fact, despite total outstanding mortgage debt topping $13 trillion for the first time in history, much of the decline in equity we’d tracked since last year’s peak has since been recovered.”

Overall mortgage-holder equity is now back above $16 trillion, with some $10.5 trillion of that being “tappable,” or available for the homeowner to borrow against while still maintaining a relatively conservative 20% equity stake, Walden said. “The average mortgage holder has some $199,000 in tappable equity available to them; down somewhat from 2022’s historic highs but still a historically large amount regardless. In terms of negative equity, or ‘underwater borrowers,’ it’s a nearly nonexistent phenomenon in today’s market – just 344,000 homeowners currently owe more on their homes than the properties are worth.”

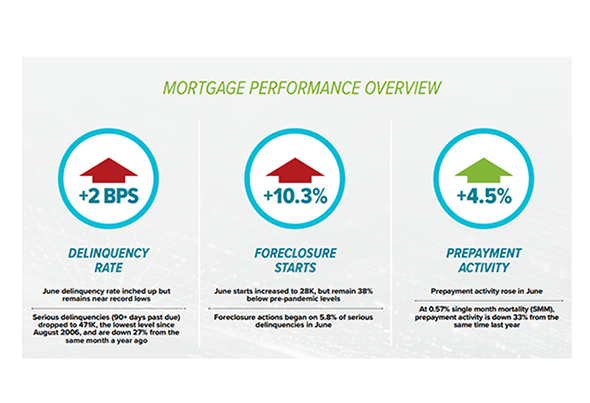

The report also quantified the savings associated with recent refinance waves, which continue to pay dividends in terms of both performance and overall economic benefit. “While affordability for prospective homebuyers is nearly the worst it’s been in 37 years, low interest rates locked in during the COVID era continue to keep payments down for existing homeowners, contributing to low delinquency levels,” Black Knight said. “Despite the average unpaid principal balance of existing mortgages hitting an all-time high in June ($242,000), the average interest rate on those loans sits at just 3.94%. Existing homeowners who have benefitted from $42 billion in cumulative savings through refinance in the past three years are now also benefitting from strong income growth as well.”

Furthermore, existing homeowners need just 21% of the median household income to make the average monthly P&I payment as opposed to more than 36% for prospective homebuyers in today’s market, the report said. “The small relative share of income needed for existing homeowners to meet their mortgage obligations, along with the strong credit quality of today’s mortgage holders and an acute focus on loss mitigation by the industry at large, are all contributing to today’s 16-year low in seriously delinquent mortgages.”