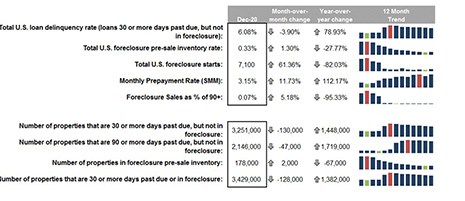

Black Knight, Jacksonville, Fla., said 2020 ended with 1.54 million more delinquent and 1.7 million more seriously delinquent mortgages than at the start of the year, a looming reminder of the challenges facing the market in 2021.

Tag: Mortgage Foreclosures

Black Knight: Mixed Results on Delinquencies; Monthly Prepayment Activity Hits 16-Year High

Black Knight, Jacksonville, Fla., said its “First Look” Mortgage Monitor showed while overall delinquencies continued to show improvement, serious delinquencies rose by 376,000 and are now up more than 1.8 million from their pre-pandemic levels.

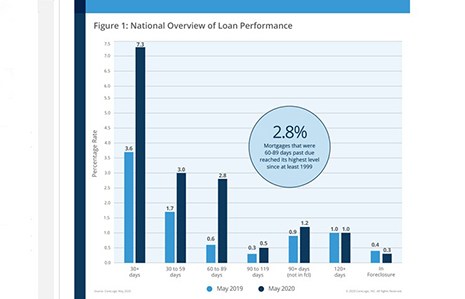

CoreLogic: ‘Clouds on The Horizon’ for Many U.S. Homeowners as Delinquency Rates Climb

Ahead of next week’s 2nd Quarter National Delinquency Survey from the Mortgage Bankers Association, CoreLogic, Irvine, Calif., said early-stage and adverse mortgage delinquency rates increased for the second consecutive month, with all 50 states and more than 75% of U.S. metro areas seeing increases in overall delinquency rates.

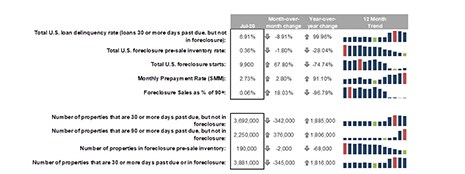

Black Knight: Mortgage Delinquencies Improve for the First Time Since January; Serious Delinquencies Surge to 9-Year High

Black Knight, Jacksonville, Fla., said after rising from 3.2% in January to 7.8% in May, the national delinquency rate improved for the first time in five months, falling to 7.6% in June as the overall number of past-due mortgages declined by 98,000.

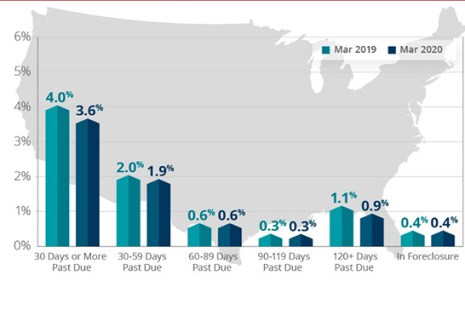

CoreLogic: Delinquencies Stay Low Despite Pandemic Impact

CoreLogic, Irvine, Calif., said its analysis of March mortgage delinquencies and foreclosures found despite the early impact of the coronavirus pandemic, delinquencies remained relatively low.

Black Knight ‘First Look:’ March Delinquencies First Sign of Coronavirus Impact

March is usually the strongest month of the year for mortgage performance, says Black Knight, Jacksonville, Fla. Not this year.

Black Knight ‘First Look:’ Foreclosure Starts Lowest Level on Record; February Delinquencies Up Slightly

Black Knight, Jacksonville, Fla., said February foreclosure starts fell 25% from January and 20% from a year ago, reaching their lowest level on record since it began publicly reporting the metric in 2000.

CoreLogic: December U.S. Delinquency Rate Lowest in 20 Years

CoreLogic, Irvine, Calif., reported just 3.7% of mortgages in some stage of delinquency in December, the lowest for a December in more than 20 years.

Black Knight First Look: Mortgage Delinquencies Fall to Lowest Level on Record

Black Knight, Jacksonville, issued its First Look Mortgage Monitor, reporting mortgage delinquencies fell by more than 5% in January, hitting their lowest level on record dating back to 2000.

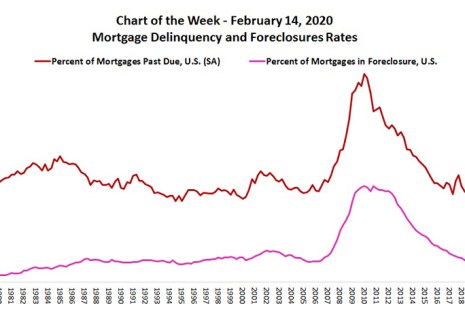

MBA Chart of the Week: Mortgage Delinquency and Foreclosure Rates

Last week MBA released its latest National Delinquency Survey for the fourth quarter. Mortgage delinquencies track closely to the U.S. unemployment rate, and with unemployment at historic lows, it’s no surprise to see so many households paying their mortgage on time.